The Business Broker

10 Facts Every Business Owner Must Know Before Engaging Business Brokers

Selling a business is a significant event. Getting the business broker choice wrong, as most business owners do, is an expensive mistake.

Background: We manage the UK's largest database of business brokers. We track their expertise, sector specialisation, fees, contractual terms, awards won and over 100 other data points. And we get extensive feedback from their clients. We've come to this conclusion:

The choice of business broker is the single most important decision when selling a business, it significantly influences the chances of sale & substantially increases price. But most business owners choose the wrong broker. #businessbroker

So here are the TOP 10 things you need to know about business brokers (and which business brokers won't tell you). There is a lot of information below! If it's too much to read get in touch to book a telephone consultation and discuss your specific needs.

Top Ten Facts About Business Brokers

Fact 1: The basics: A business broker is a person or firm that assists business owners with the sale of their business (whether it's a sole proprietorship, partnership, limited liability company, PLC or something else). But most of the best intermediaries who sell businesses don't call themselves business brokers! And you could be missing out on the top talent if you're limiting your search to business brokers. Here's an overview of the ecosystem, who does what and who sells what type of business. Which of these is the right one for your business?

Fact 2: How does any intermediary / broker go about selling a business? There are enormous differences in the amount of effort various entities put into selling a business, in how they go about finding buyers and closing deals (and, therefore, in their success rates and the prices they achieve for their clients). Note: It's generally accepted that the smaller the business, the less sense it makes to use an intermediary. For many micro businesses - one man bands, shops etc - it's better to not use one at all. Should your business even use an intermediary? What's the alternative? How can you sell your business yourself?

Fact 3: Brokerages, on average, sell only about 20% of the businesses they take on! Ignore the (unverifiable) claims many make of 50%, 80% or even 100% success rates. Some of the biggest & best known brokers sell fewer than 5% of the businesses they take on! What can you, the business owner, do to improve your chances of sale when using a business broker?

Fact 4: There is no national regulatory body overlooking business brokers and no qualification or licence required to practise as a broker. That has resulted in the UK having some very dubious characters operating in this industry; the industry has earned itself a terrible reputation. Some of the biggest and best known business brokers around are worse than useless. So how do you choose the right business broker?

Fact 5: When you are making enquiries of brokers you need to take extreme care with what you disclose. In many cases, even disclosing the identity of your business puts confidentiality, and the business, at risk. Here's how you protect yourself.

Once you hire a business broker, the broker should take good care of your interests and the interests of the business. But till then you need to protect yourself and your business from the brokers themselves.

Fact 6: Some brokers specialise in selling businesses in a specific sector or industry. There are major advantages to using a sector specialist - they can often get double the price that other brokers can achieve for you! But finding them is not easy. (For example, there are 20+ business brokers in the UK who specialise in selling accountancy practices and only accountancy practices. Yet you could spend all day on Google and not find even half of them!) We have some tips.

Fact 7: When considering broker fees, the choice is not as simple as no-sale-no-fee vs paying a large retainer. Some of the no-sale-no-fee brokers (not all) are highly exploitative and should be avoided at all costs. And if you do pay a retainer, how do you know you're going to get value for money? We share some valuable tips here to help you get the right deal.

Fact 8: When interviewing a broker you need to ask the right questions. And that's an art in itself. This is a considerably more important decision than when hiring an employee, but you've never interviewed a business broker before so what questions do you ask to judge their competence to sell your business? Don't be fooled by their smooth talk and well rehearsed sales pitch. We guide you through vetting brokers and asking the right questions.

Fact 9: What the broker won't tell you is that his fees are generally negotiable and that you can save tens of thousands of pounds in fees, if not more, if you do and say the right things! But it's not a simple matter of making an offer lower than his quote. Don't ever do that to a corporate finance firm or M&A adviser, these professionals get easily insulted! You need to play it smart if you want a lower price. We know how to negotiate price because we've negotiated countless such deals. How can you negotiate a better deal with the broker? Find out here.

Fact 10: You need to read the contract extremely carefully and, preferably, get it looked at by a trusted lawyer. Some of these contracts look straightforward but there are a lot of stings in the tail. We show you what to watch out for.

1. Which type of broker is right for you?

Getting the right type of broker is important if you wish to maximise price (and improve your chances of successfully selling your business). All of the below players handle the sale of businesses, and here's a brief description of each to give you an overview of this ecosystem:

Business Transfer Agents (BTA): A firm calling itself a BTA is squarely at the bottom of the market selling the smallest businesses - one man bands, newsagents, hair dressing salons, cafes, shops, corner stores and the like. Some business transfer agents call themselves business brokers - there is no clear distinction between the two. There are no qualifications one needs to set up as a BTA or broker and most have no formal training. There is also no industry body overseeing their work, no registration scheme, no vetting of BTAs, no ombudsman to whom you can complain if things don't pan out.

Business Brokers: These range all the way from firms selling the above one man bands etc., to firms selling enterprises and corporations worth a few million pounds. As above, no qualifications are required and there is no industry body to whom they are accountable to. Any claims they make of being members of an industry body should be taken with a pinch of salt as there is no national or international body of any worth. Some of the larger brokers, however, may have one or more accountants / lawyers working in the business and those are governed by the codes of conduct of their own professional bodies (ICAEW and the SRA respectively).

While the UK has many good business brokers and business transfer agents, the reputation of the industry isn't great and one needs to be extremely cautious when signing up with these outfits.

Corporate Finance Firms: CF firms typically handle the sale of 'lower mid market' businesses / 'lower mid cap' setups ie. businesses with revenue (t/o) of at least £5m (though some go a bit lower and may even accept a £1m - £2m t/o business if the net profit is sufficiently high). The largest enterprises most of them are capable of handling adequately are organisations with a value of £20m - £50m (called the middle market or mid cap market).

Corporate finance firms are typically run by qualified accountants or they at least have qualified accountants working in them. There is still no licence or authorisation required for setting up as a corporate finance firm but, given the formal accountancy background of the owners / directors, these firms are often (not always!) more professional. Some corporate finance firms are, by their own choice, registered with and regulated by the Financial Conduct Authority (FCA) which adds a significant credibility.

But just to make it confusing, not all firms with "Corporate Finance" in their name sell businesses. Some are actually commercial finance firms ie. they lend money to businesses!

M&A Advisers: M&A advisers sometimes call themselves transaction advisors or consultants or intermediaries. They are very similar to corporate finance firms in how they operate. M&A advisers and CF firms bridge the gap between business brokers and investment banks. Again, there is no legal requirements on these firms to be registered or licenced (so you still get a mixed bag). M&A advisers sometimes get involved earlier in the process - assisting with exit planning, and strategic planning years before a concern is taken to market. Many also provide business growth advisory services and are focused on creating / identifying opportune environments for a “liquidity event” in line with the management’s strategic objectives. They don't need to have formal qualifications to do this job, but most of them do. Like with CF firms above, some M&A advisors are regulated by the FCA.

Investment Banks (IBs): While all of the above handle what are called 'Main Street' businesses, IBs handle the sale of 'Wall Street' businesses, a term generally used to mean 'mid market' or 'mid cap' companies - megacorps with a value of over £50m. IBs also assist with raising finance – both equity and debt - for expansionary activities and they get proactively involved in guiding the strategic vision of the management team towards the objective of IPO, merger or acquisition. IBs are heavily transaction driven with enterprises paying large retainers and large monthly fees for advisory services and for underwriting their securities.

At this level, transactions and deal structures are complex and require significant corporate finance expertise together with a keen understanding of the regulatory environment to ensure compliance. In the UK investment banks are heavily regulated.

Commercial Real Estate Agents: CRE agents and commercial property consultants handle the sale of commercial properties - they sell everything from freehold shops and industrial units to B&Bs, factories, leisure centres, shopping complexes and airports ie. their focus is the real estate / property. Many CRE agents do a bit of business broking on the side - they'll take on the sale of a going concern, a trading operation / leasehold business, either on its own or together with the sale of the related property. Some CRE agents also handle the valuation and sale of assets. So if a business is not working out and the owners want to get rid of the stock, machinery or other assets they might call a commercial real estate agent (who may also go by the moniker of 'asset valuer', 'asset assessor' or 'commercial property consultant'). These agents would be able to value the stock and place or auction it.

Which firm is the right partner to sell your business? This isn't easy to answer. Given the reputation of the BTAs and brokers, it may be worth the owner of a small business not using a BTA or broker but selling their business themselves.

For larger businesses it's important to get a broker not just matched to the size of the business but one that understands the sector as well (in addition to a lot of other criteria). And it isn't easy. There are 1000+ firms in the market and there is no directory to help you find the one that is best geared to selling your business. Have a look at the huge range of broker talent we enjoy in the UK.

We assist with getting the right broker - advising on the right partners and using our comprehensive data on the industry to match you with the right partner / intermediary and at the right price. Fill in our form to find out more.

2. Is your business too small for a broker?

- how do brokers sell businesses?

A business needs to be a certain size to benefit from the assistance of a business broker. We've explained the logic here. In short, if the business is not large enough it can't justify the broker fees required to do a proper job and the only brokers that would take it on are the not very good ones!

In our many years of matching businesses with brokers we've found that the competent brokers won't take on enterprises that have a turnover of less than £5m. Yes, their threshold is as high as that! Some will take on a company turning over as little as £1m - £2m but only if it's otherwise a very attractive package ie. the firm has a high net profit or a couple of million in assets (and therefore could sell for a higher price).

So what do small businesses do?

Most small companies, especially one man bands, sole proprietor firms and sole traders, are left with the only option of using "business transfer agents" or the "we take on any old rubbish" brokers - the mass market operators.

These small businesses tend to end up with the likes of KBS (Knightsbridge), Intelligent Business Transfer, RTA, National Business Sales, Blacks, or a number of no-sale-no-fee business transfer agents / brokers. We advise these micro, mini and small operations (under £1-2m in turnover) to avoid the pile 'em high and sell 'em cheap brokers. This is not just because these organisations tend to not get the best price for businesses (or anywhere near the inflated valuations they hand out to business owners!) but also because most are dismal at selling businesses and the large majority of the businesses on their books never find a buyer even after 24 months of the business sitting on their shelves!

So how do you sell a small business?

We advise owners of small businesses to sell their business themselves. The bottom end brokers usually just create a slapdash ad (some examples!) and post the business online at various marketplaces.

The business owner can do that himself fairly easily and without shelling out 5% or 10% of the value of his business to the broker in "success fees". And without exposing his business to the risks inherent with using some of these brokers. There is typically a small cost to advertising on the above marketplaces, but canny entrepreneurs can use our offer here to get even that for free! And if they do feel they need some assistance along the way when conducting a DIY sale, we offer a range of services, just get in touch.

If you want a detailed breakdown of what proper brokers do differently to the mass market ones, click the above tab labelled "How Do Brokers Sell Businesses?"

3. Business broker success rates

80% of businesses that go to market do not find a buyer. In fact, many mass market business brokers sell fewer than 5% of businesses they take on! #businessbrokers

The problem with "success rates": When investigating a business broker with the intention of using their services, it's reasonable to want to know what percentage of client businesses the broker successfully places / sells. You can't take the broker's word for it, obviously! There are multiple reasons apart from the fact that they are probably lying to you.

You need two pieces of information to work out their real "success rate". The first is the number of businesses they've taken on and the second is the number of businesses they've actually sold.

But if the broker doesn't give you access to all his accounts and his books you have no way of getting these numbers, unless....

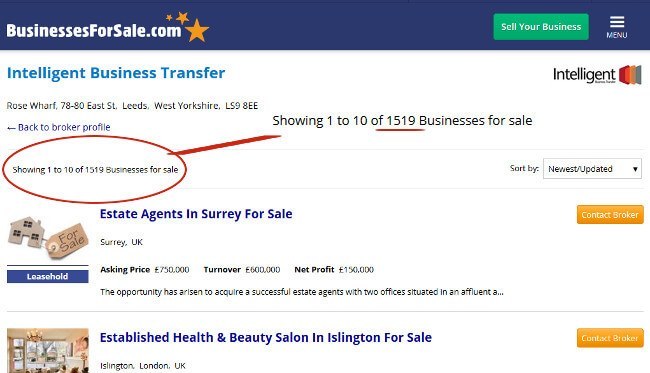

We found a way to estimate most brokers' success rates: Many business brokers use the main marketplaces and list all their client businesses on these marketplaces. So, for any individual broker, it's easy to get a fair idea of how many businesses they've got on their books. For example, if you want to see how many clients Intelligent Business Transfer (a large broker in Leeds) has, you can head to businessesforsale.com, find the relevant broker page, and you'll see how many businesses they've currently got listed. Here's a snapshot taken on Feb 18th, 2019 showing a massive 1,519 businesses currently on their books!

The same can be done for any other mass market broker. Kings currently has 120 listed, Blacks has 736, Turner Butler has 212 etc. (By contrast, corporate finance firms and the higher end brokers tend to have fewer than a dozen they're handling at any given time!)

So, for most mass market brokers, we can get a good picture of how many clients they have on their books. But how do we know how many they've sold? That takes a bit more time and effort.

If a business has been sold, the ad is generally removed from the marketplace or it's prominently marked with a "Sold" sign. So we tracked all the ads posted by some of the mass market brokers in the UK. We found that, for some of these brokers, over 90% of the businesses they'd taken on were still being advertised for sale over a year later! Fewer than 5% had actually been marked as sold.

There's another way to track the ones they've sold. Follow the broker on social media and you'll get informed every time they've made a sale (because they do make a big song and dance about it when they've sold a business!) If they've got 1,000 business on their books and they are selling one a week, it's nothing to write home about as that's roughly just 5% of client businesses being sold in the average year. 95% are failing to sell.

So how do these brokers survive?

First, they generally charge a retainer at the point of signing the client up. This could range from a few hundred pounds to the £5K or more charged by the likes of KBS Corporate. Even assuming an average of £1,000 per client, taking on a thousand clients generates a cool £1,000,000 in fees! If they sell even 5% of those business, the success fees are a nice bonus. Given that these mass market brokers tend to take on cheaper, lower end businesses, let's assume the average price at which they sell client businesses is only £200K. The average success fee is then £200K*(5% of 1000 clients)*6% success fee = an additional £600,000.

But for many of them the "success fees" is actually a bonus, most of their earnings come from the "sign on" fee or the retainer. [[Added: See our analysis of the 2019 earnings for the K3 Group - Knightsbridge Business Sales and KBS Corporate, the UK's largest broker - they make 60% of their fees from retainers!]]

So what can you, the business owner, do to improve your chances of sale: First, if your business is a micro or small business, under say a couple of million in turnover, our advice is to consider selling the business yourself rather than using a broker. If the very idea of DIY is terrifying, talk to us about free resources and other options available to you including what we call the Assisted DIY route.

If your business is large enough for the better business brokers, corporate finance firms and M&A consultancies, we can assist to find you the one best suited to your specific business, and at the right price. Many of them genuinely have success rates of 80% or more (but, to be fair, those success rates are partly because they take on only highly attractive businesses - businesses that are more likely to sell in the first place!).

4. Choosing the right broker

Solicitors are regulated by the Solicitors Regulation Authority. Accountants have to follow the ICAEW code of conduct. Every other professional or trade - from dentists to plumbers - has a trade body, industry body or regulator.

Business brokers have nobody! There is an organisation in the US called the International Business Brokers Association (IBBA) but there's nothing international about it, it's very much a US affair. In the UK, a couple of small town business brokers got together and started a "Federation of Business Brokers" many years ago. However, almost no brokers signed up to it so it never took off. Neither the FCA nor the Financial Intermediary & Broker Association regulate business brokers (despite the latter's name)!

So if you have a complaint about a business broker, there's no industry body you can go to for a resolution. And there are thousands of complaints against brokers every year! You can research this topic, and the disputes that regularly end up in court, at the CEBTA site.

Quite simply, it's very easy to make the wrong choice when signing up with a business broker.

The good news: After years of experience finding the right brokers for business owners, we put together a detailed article for you on how you can find the right business broker for your business (apart from simply using our paid service!)

5. How do you protect against brokers leading confidentiality?

For most businesses it's vitally important that news of the intended sale is kept confidential. Significant value in the business can be lost if staff, customers or competitors know that the owners are considering selling.

But maintaining confidentiality is easier said than done. When emailing a business broker to make enquiries, you could be disclosing your company name in the email address. When doing an online valuation of your business you are entering figures that could be used to reverse engineer the identity of your business. Even visiting a business broker's site could reveal your identity via your IP!

But is there any danger in revealing it to a business broker? Generally, no. But some brokers have been known to "follow up" on an enquiry by calling on the company phone number (which is often answered by a member of staff). There have even been cases where the irate broker, in an attempt to get past the "gatekeeper", said that he needed to be put through to the boss because he was calling about the sale of the business. Yikes!

We've put together a series of three articles on maintaining confidentiality in the early stages when making enquiries of brokers.

6. Do you need a sector specialist broker?

Some brokers specialise in selling businesses in a specific industry, trade or sector. In our article here we explain why hiring a sector specialist can make a big difference and get the vendor a much better price. We estimate that using a sector expert can make a difference of as much as 250% in price.

But finding all the brokers specialising in a specific sector is not easy as there is no public database or directory with this information. To the best of our knowledge, the database we maintain is the only comprehensive source of this intelligence in the UK.

And it's amazing just how many sector specialists there are in the UK!

For example, in 2018 there were about two dozen brokers specialising in the sale of just accountancy practices! They include the likes of Abbott & Crowe, Bains Watts & Co, Draper Hinks, Goldsmiths Accountancy Advisory Services, Maximiti Ltd, Nicolson Accountancy LLP, Owens Professional, Proctor Partnerships Ltd, Retiring Accountants, Swat UK and Vivian Sram Ltd.

The mass market business brokers never specialise - they tend to take on anything and everything, whatever the size, whatever the sector! Going with them is not the best way to achieve top price. #businessbrokers

Interestingly, none of those names come up in Google searches for business brokers! If you were an accountancy practice looking to find a good broker to sell your practice, and using Google, you'll have missed the UK intermediaries most competent at selling accountancy practices. By extension, you'll also have lost access to the strategic, industry specific buyers who go directly to these brokers!

Similarly, if you were looking to sell a recruitment agency, there are over a dozen specialist brokers - names like Boxington, Chartswood Group, CS Consultancy, Henders Management Ltd, Optima Corporate Finance etc. Again, you won't find a list of these in Google. There are numerous other specialist brokers handling just manufacturing businesses, or financial ones, or care homes, or nurseries. There are some who handle only businesses in the hospitality / marine / agricultural / tech / software or SaaS / cosmetics / automotive and whatever other sector you can imagine.

(Note: Some larger brokers have 2-3 areas of specialisation.)

In the second tab in section 2 above we discussed how the better brokers - the higher end business brokers together with corporate finance firms and M&A consultancies - go about selling businesses. It also happens to be the case that these intermediaries are the ones more likely to have a sector specialisation or two. Read our longer article on why you need a sector specialist to get the best price for your business.

We are the only ones who have a comprehensive list of which brokers specialise in which sectors out of the 1000+ business brokers in the UK:

Hiring a no-sale-no-fee broker is NOT a zero risk proposition. Some of these business brokers are the most dangerous and exploitative ones around and account for the large majority of cases that end up in court.

7. How much do business brokers charge?

Some facts before we go on to examples of fees:

- Almost all brokers have a "success fee" - payable if they successfully sell the business;

- This fee is a percentage of the sale price: generally from 1.5% all the way to 12%;

- The larger the business, the smaller the percentage: 2% would apply to £10m+ firms;

- Corporate finance firms etc., selling the larger businesses, charge lower percentages;

- Businesses of under £1m in value tend to get charged 5% - 12%;

- Many brokers also charge a retainer at point of engagement;

- Retainers can be as low as £500 (for a micro business) or £50K (for a £10m firm);

- Some brokers are willing to spread the retainer payment over several months;

- A few brokers charge 'milestone' fees (at signed Heads of Terms, for example);

- Some brokers at the bottom end of the market operate on a no-sale-no-fee basis;

- With lower end brokers there's often a 'penalty' payable if you take your business off the market.

Some examples of fees:

Here are a few examples to give you a flavour of the different kind of fee structures you're likely to see in the industry.

BCMS Corporate (a generalist broker) charges a fixed fee of £44,700 + VAT payable in six monthly installments and while they are marketing the business. This is for a business with turnover circa £5M. For smaller businesses (£350K – £1M Turnover), it’s about £15,000 for the marketing. In both cases they charge a commission on successful sale – the greater of 3% or £35,000.

Blue Box (a generalist broker) charges a flat rate of £30,000 for the 'initial assessment'. Camlee Group, and a few other corporate finance firms, charge a retainer of £20K - £30K and a success fee of 3.5%. Large accountancy firms that sell businesses - such as AAB - also charge in this ballpark. AAB charges £25K - £30K with a success fee of 3%. Similar fee levels at TranscendCorporate, Orbis Corporate Finance and about 120 others.

Equiteq, who specialise in selling management consultancies, charge a retainer £5K a month and a success fee of between 1% and 3%.

With KBS (Knightsbridge) it's common to get a quote of £5K as retainer and 4% of the selling price for a business valued at £400K-£500K but sales reps seem to have some flexibility in what they quote and do sometimes quote more.

HarrisonSpence (who specialise in selling retail financial firms) charge a £2,000 retainer followed by a 5% success fee (but they also charge the buyer 2%). Hornblowers (who sell engineering businesses) charge £2,500 as a retainer, another £2,500 on 'heads' and a success fee of 5%.

Most small brokers and a few larger ones charge no upfront fees. Examples: Turner Butler & Co, Bernard Baxter, Ashley Tate … and about a hundred others. Some charge a fee if you take your business off the market. With Knightsbridge (KBS) that fee is apparently £1,000).

We strictly do not recommend the use of any no-sale-no-fee brokers. If your business is too small to justify the fees for a proper broker, our advice is to sell the business yourself.

Getting value for money:

For clients who want a competent and highly capable broker, there's no way around it, they are going to have to pay a retainer. Why? For two reasons.

First, these brokers are going to put in a lot of effort - hundreds of hours of effort. They will add substantial value to the business by analysing the accounts and financial ratios, calculating EBITDA, valuing the enterprise, preparing various documentation - from business plans to financial projections to the Confidential Information Memorandum - and done a lot of other leg work. And they'd have nothing to show for all that time and effort if the client pulls out. Taking a retainer is part compensation for that time but also evidence, for them, that the client is serious about selling and is not just 'fishing around'.

But there's another reason: Quite simply, they charge a retainer because they can. If they are good at what they do then they are in high demand. When we are matching clients with brokers are frequently amazed at how many clients some of the best brokers turn down. They turn these clients down purely because they are fully booked up! (Unlike the mass market brokers, they are very selective in what they take on.)

But how do you know whether the broker to whom you're paying a large retainer is any good at what he does? And whether it's worth you risking that money?

The best way is to sign up for our broker matching service and take advantage of our data and expertise. However, if you're doing it yourself, there's no alternative to a lot of painstaking research. Have a careful read of our page on how to choose a broker. Then get back and study our section below on good questions to ask a business broker.

8. Good questions to ask a broker

Below are some of the questions we advise our clients to ask when interviewing brokers. There are other good questions, but we aren't including them here in this free guide.

1. Who will be handling my account?

With lower end brokers it’s not uncommon for one person to sign you up, get his commission, and hand you over to a bunch of poorly trained, call centre staff!

It's a good idea to ask for the name/s of the person/s who'll be handling your sale and who'll be updating you on progress.

2. How much do you charge, what is your fee structure and what do those fees cover?

Get a clear picture on this right at the start. When you eventually sign the contract make sure that the terms match exactly your understanding of their charges.

3. Is your key contact capable of advising on multiple exit options?

A trade sale may not be the best option but brokers who have no experience in, say, Management Buyouts, would seek to guide you to the exit that pays their commission. Take names, titles, experience and qualifications of the people who’ll be involved in selling your business. Check them out in LinkedIn.

4. Who will be conducting the valuation of my business and are they professional accountants?

Brokers normally value businesses themselves arguing that their vast experience with real life mergers and acquisitions puts them in a better position than accountants.

Maybe, maybe not.

Remember that a broker has incentive to inflate the price in an attempt to gain your instruction. An unrealistically priced business will put buyers off. Starting off high and lowering the price later simply makes you look desperate.

5. Will you put the valuation in writing along with the reasoning behind the figure/s?

How often does he list a business at one price and then recommend to the seller six months later than the price needs to be reduced, followed by another reduction when even that price doesn’t work?

6. What exactly can I expect from you at various stages of the process?

How much of work will they be doing, what work, and how will they keep you updated?

7. Where , how & for how long will you market my business? Can I see examples of teasers & CIMs you’ve written?

Do you find those CIMs well written, persuasive, professional? If you were a business buyer would the teaser tempt you in? Where will they be advertising your business in ...and for how long.

8. Have you successfully sold businesses like mine? Any examples?

Ideally they’d also be able to provide testimonials from named (not anonymous) business owners who’ve successfully sold through them. Get an idea of the typical size of the client businesses they sell and the sectors they specialise in.

Their understanding of and track record in selling your type of business is what you’re after.

9. Negotiating price and terms with a broker

Most brokers are open to a bit of negotiation on fees and we've put some tips together for you but, unfortunately, you're not in a position to negotiate the best price, we are. Being a potential source of future leads for the broker puts us in a much stronger position and we have often negotiated a whole percentage or two off of the success fee and a reduction of £20,000 or more on the retainer!

We've also convinced brokers to spread their retainer over several monthly installments and to give our client a break option if at any point the client didn't feel they were getting value for money.

But we've put some tips together for you anyway. Please find them here.

10. What to look out for in the broker contract

Before he acts for you the broker is going to want you to sign a contract. The contract may be called by many names - engagement letter, instruction letter etc.

Whatever the terminology, it's a contract and it's a legally binding contract at that. Sometimes the "letter" terminology makes business owners complacent and they proceed without independent legal advice.

That's a serious mistake!

Some hard-sell brokers pressure business owners to sign earlier rather than later and even provide incentives to encourage an on-the-spot decision. However, even the genuine, reputable brokers are going to have contracts that are drawn up to protect their interests not yours. So it's a good idea to have the contract vetted by your lawyer.

14 day cooling off period

There is none! Cooling off periods exist to protect consumers, not businesses.

This is a business to business contract. Even if you sign the contract in your own name rather than as the business owner, you may not be able to rely on that in court to justify pulling out of the contract within the 14 day period.

Once your contract is signed, it's signed, and it's difficult to impossible to get out!

The Danger Of Off-Contract Clauses

Read ALL parts of the contract: Is there a flip side to the document? It's more likely to host the terms that are not in your interest.

Another common practice is off-paging: ! It's worth studying the contract carefully for references to off-page terms & conditions, T&Cs that reside on their website or elsewhere.

Per Hour Billing Is An Incentive To Take Longer

Hourly billing is common with some professionals. With a broker, however, it is not necessary and you could be opening yourself up to some pretty hefty charges that you find difficult to justify but which you are contractually obliged to pay.

Many good brokers do take an upfront fee, and some are worth it, but make all the enquiries you need to satisfy yourself first that you’ll be getting value for money and include a way out should you discover it’s not working to your satisfaction.

Transfer Of Contract

It's worth strictly refusing to accept any condition that allows the transfer of your contract. If your broker goes bust you don't want their rights transferred to an unknown third party. Regularly going bust is part of the “business model” for some brokers.

Calculation Of Broker's Commission

High risk activities:

- Agreeing to pay a percentage of the valuation price (rather than the achieved price).

- Agreeing to pay the broker's full success fee in cash on the exchange of contracts (if it's not a 100% cash transaction, you may not have the liquidity)

Good Faith

There is no legally accepted definition of Good Faith and a promise to act in good faith may be worthless as "good faith" is subjective.

Power Of Attorney

A Power of Attorney gives the broker the power to accept or decline offers on your behalf. You might want to ensure the contract says he’s acting only as an agent. He can enter negotiations on your behalf & agree to figures and terms … provided he makes clear to the investor that it's provisional & subject to your final approval.

Penalty Clauses

If there’s a penalty for you withdrawing from the sale, it's worth negotiating it to be a fixed penalty figure to compensate the broker for the time he spent on this now aborted sale. Tying it to to either the original (possible unrealistic) valuation or even to “offers” received from buyers is an unnecessary concession to make.

Notice Periods

A notice period is a notice period: If you are required to give a 30 or 60 day notice period prior to withdrawing their instructions, are there conditions they've imposed? Some brokers stipulate that if you cancel the contract while a potential buyer is showing interest you are still liable for the commission. Given it’s not difficult to fake a “potential buyer” it pays to be cautious about conditions tied to the notice of termination of contract.

We have copies of hundreds of contract / engagement letters from brokers all over the UK and have seen the good, the bad and the ugly. We advise our clients on getting the right terms when they sign up with a broker.