Intelligent Business Transfer (Intelligent Business Partners): Reviews, Feedback, Complaints, Testimonials, Fees, T&Cs...

Overview

Intelligent Business Transfer (IBT) is a Leeds based business transfer agent. This review was written in January 2018. Some of the information below may be out of date. You should always seek the most current information and conduct your own research; we've provided some links below to assist you. Please also see our guide to interpreting reviews.

Address: Intelligent Business Transfer Ltd, Riverside Suite, Rose Wharf, East Street, Leeds, LS9 8EE

Update: In May 2020 they changed the name of the business to Intelligent Business Partners Ltd.

Phone: 0800 612 7718

Website:

http://www.intelligent.co.uk (and http://intelligentbusinesstransfer.com/ which redirects to the previous domain). They also own http://intelligentcorporate.co.uk which is their offering for slightly larger companies .

Social Media: They have a LinkedIn page with 22 employees on LinkedIn. They do also have a Twitter presence and a rarely used Facebook account.

Note: Intelligent Business Transfer Ltd does not appear to be connected with the similar sounding Intelligent Business Sales Ltd which is based in Manchester.

Information we have on this company: We have copies of their Terms & Conditions, fees, invoices, signed agreements, quotes, valuation reports and correspondence they've exchanged with previous clients. We have several examples of fees they've quoted to clients (and the fee structure). Some extracts from that information, and snapshots, are reproduced below.

Fees

Our database of intelligence on business brokers includes detailed information on the fees various brokers charge, their fee structures and the extent to which their fees are negotiable. Information we have on IBT fees include the below. Note: This is not hearsay data but data extracted from quotes IBT has provided to clients (and which their clients have shared with us).

In a case where IBT valued a business at £20,000 they quoted a "registration fee" of £500 and a "commission" of £2,500 in the event of a successful sale. For a business with an asking price of £100K IBT quoted a "registration fee" of just under £2,000 and a "commission" of £6,000. For a business at just under £300,000, IBT quoted a "registration fee" of £850 and a "commission" of 5% on the sale price. VAT is to be added to all of the above figures.

Intelligent Corporate, their offering for larger businesses, has an "book rate" of £20,000 + VAT as a retainer + a percentage of the sale price as a "success fee".

Valuations: IBT typically meet with the prospective client and produce a professional looking valuation report based on their company template. They make no charge for this valuation report.

Company records, director information and financials (balance sheets etc): You can get information on this company from the free service at Companies House: Company Number 06613925.

How they attract clients: They use other methods as well but are known to run extensive cold calling operations. Cold calling business numbers is legal in the UK but there have been numerous complaints about IBT's cold calls from, for example, 0113 419 999 (see example complaints and a few more).

Our Summary: We recommend further research and have provided some links below.

Reviews

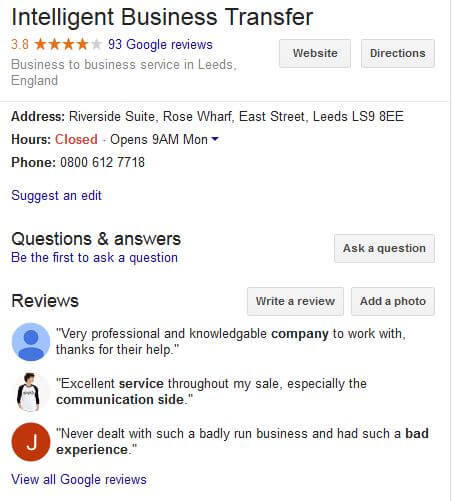

Google Reviews: This is where the company has the highest number of reviews - 93 reviews - with an average score of 3.8 out of 5. To get to the Google reviews one needs to search Google for the company name ...and follow the links in the right column. (Google doesn't make it easy to link directly to the reviews.)

There are several positive reviews claiming that the company provided a very professional service and there are a few scathing criticisms. Google offers the option of a drop drop filter to sort reviews in order of highest or lowest scores.

TouchLocal: This business has numerous reviews at TouchLocal, going back to 2011, and with an average score of 4 out of 5.

Complaints Board: Two complaints and one compliment.

Extracts:

"I saw a business that I was interested in through IBT. Flagged as having turnover of £442k, gp of £86k and np of £68k. However the turnover is actually £261k, gp £55k and np £15k. I asked the vendor where IBT got their figures and even he doesn't know. The business has already been reduced - but the current asking price makes no sense when looking at np multipliers for bricks and mortar retail. This is the second business through IBT where their particulars do not match reality!"

"I've recently bought a business through them and found quite the opposite. I've also had bad experiences with agents, but found these particularly helpful and even turned up at a meeting with the seller of my new business to help sort a deal. "

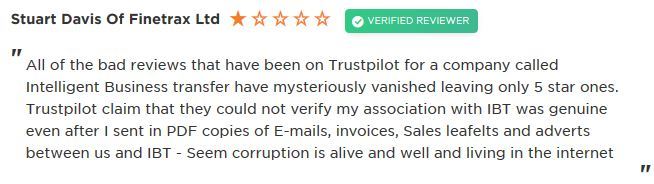

Trust Pilot: There are three 5 star reviews (the highest possible) but Trust Pilot have removed the overall rating for this business as they claim that they have discovered "a large number of fake reviews" for this business. Out of the current three 5-star reviews two are from parties who have no other history with TrustPilot i.e. their review for IBT is the only one they've ever written. The third party has two other reviews to their name (for unrelated businesses).

Elsewhere, there is a complaint that TrustPilot deleted numerous negative reviews for Intelligent Business Transfer. Note, however, that it's a review of TrustPilot rather than of IBT.

Scoot: IBT seem to have two pages at Scoot reviewing their business. Page 1 | Page 2

The average review is four-star with two positive reviews and one negative one. Samples: "Agreed sale of my business in 8 weeks, completed in 12 . Well worth the fees" and "Sham of a company. Shoddy particulars. Do not do what they promised. They owe us £1000 + vat".

Glassdoor: This is a site where employees review their employers. Employees of IBT have rated the company an overall 2.8 out of 5. Comments seem to be around employment being "performance led" and with an aggressive sales culture (as in selling the company's services to clients, not sale of businesses to investors). There are four reviews, two positive and two negative. All seem to be written by staff in the Sales department. This may suggest that the majority of employees at this company are staff who specialise in sales / lead generation.

Other Review Sites: Intelligent Business Transfer has no reviews on these reviews sites as of the date of this article: Epinions.com, ReviewCentre.com, ResellerRatings.com, Feefo, Yelp, SiteJabber etc. The company also publishes a page on their site with reviews they claim to have collected from the customers.

Job ads: The only job ads we could find for this business were for sales related positions - "lead generation".

Financials

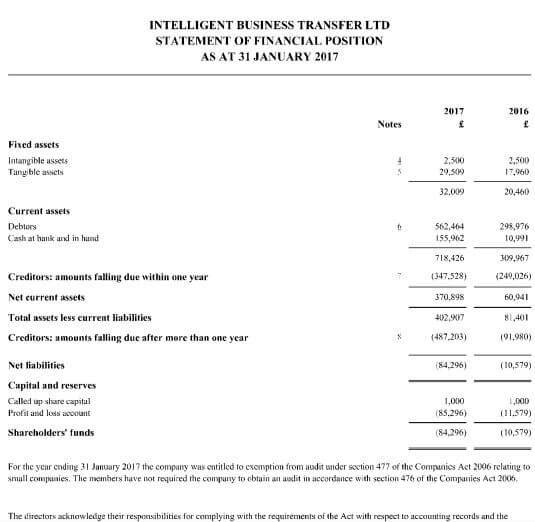

The last accounts filed were for year ending 31st Jan, 2017 and showed a negative net worth for this company (-£84,296). The previous year's figure was negative as well (- £10,579). The balance sheet on its own does not provide a full picture of the financial health of a company. Further information can be obtained by researching the company using credit reference agencies and / or locations like this one.

Update 2019: The company's financial position seems to have deteriorated further and the company has a book value of a negative £699,445.

Update 07/07/2020. The company has today filed their annual accounts with Companies House. Their balance sheet now shows their book value decreasing from a negative £699K to a negative £1,324,130 with a large rise in creditors.

Contract Terms

Note: We do not provide legal advice but would recommend you speak with a lawyer particularly about clauses 2.1 and 5.2 of the Intelligent Business Transfer Ltd contract if the contract they present you is similar to the one we have on record.

Clause 2.1 says that the contract is open ended. If IBT hasn't sold a client's business within the contracted 12 month period the contract gets automatically extended indefinitely till one or the other party gives 28 days notice of termination. In other words, it would appear that unless this contract is cancelled in writing (only by recorded delivery or registered post) a client selling their business independently even years later may be liable to pay IBT the "success fee":

"The Term of this agreement (“the Term”) shall commence on today’s date and shall continue for a minimum period of twelve (12) months continuing thereafter until terminated by one of the parties giving to the other not less than twenty eight (28) days notice in writing (recorded or registered post)."

Clause 5.2 covers the conditions under which a client would have to pay IBT their entire commission / success fee even if the business is not sold.

"For the purpose of this agreement I/we accept that I/we shall have been deemed to have prevented you from selling my/our business and/or property and as a result agree to compensate IBTL by way of payment of full commission (our bold) agreed in clause 3.3....(if)".

Some of the conditions covered under 5.2 include a) not arranging an Energy Performance Certificate for the property within 14 days when required to do so and b) not paying the registration fee on time.

Note: IBT's contract may have changed and/or your interpretation of their contract could be different to ours. Our recommendation is to always get professional legal advice before signing any broker contract.

Market Presence

IBT is one of the UK's largest business brokers by number of listings. Most of the businesses handled by IBT are "main street" businesses - shops, cafes, salons and the like. IBT has a total of 826 businesses for sale at BusinessesForSale.com and 1866 businesses listed at Daltons (with some overlap) - there are 15 businesses at or under £10,000 in price and 920 businesses with asking price of £100K or below. IBT's clients are from all over the UK and not just from around their base in Leeds.

Image of the interior of their office.

Latest News

Oct 21st, 2019. This company has published their annual accounts at Companies House, available here.

Over the last few years the "Shareholders Funds" or "Book Value" of this business has worsened from a negative £10,579 in 2016 to a negative £84,296 the following year. It got worse in 2018 dropping to a negative £108K.

However, in the latest published 2019 accounts the situation seems to have deteriorated sharply to a negative figure of circa £700,000. The creditors have more than doubled and the loss transferred from their profit and loss account to their balance sheet is a little over £700K.

It is not our point that the company is in immediate danger of collapse as there are several other factors that go into assessing a company's risk, data which we don't have access to. We simply point out the figures as published at Companies House.

Your Feedback

Errors & Omissions: If there is any information on this page that you feel needs to be corrected, or other important data that you feel needs to be included, please contact us.