Knightsbridge Business Sales & KBS Corporate: Reviews, Feedback, Complaints, Fees, Testimonials, T&Cs ...

Overview

Reviews

Past Financials

Market Presence

Extracts From Their Contract

2019 Financials

2020 Financials

Overview

Knightsbridge Business Sales Ltd (KBS) and KBS Corporate Sales Ltd (KBSC) are owned by K3 Capital Group Plc which listed on AIM in April 2017 (AIM:K3C). KBS typically sells businesses of up to £500K in value and KBSC handles the sale of businesses they value at over £500K (up to about £5m). Both companies "cover all sectors including retail, catering, care, commercial, licenced and leisure markets".

We've collected some information about these business broker companies below which should be of interest to business owners considering instructing KBS or KBSC to sell their business. This page was created in January 2018. However, please note that some of this information may be dated. Please seek the most current information and conduct your own research. Please also see our guide to interpreting reviews.

Address: Both companies are registered at KBS House, 5 Springfield Court, Summerfield Road, Bolton, England, BL3 2NT

Phone: 01204 227 661 (KBS) and 0161 951 5509 (KBSC)

Websites: KBS is at KnightsbridgePLC.com and KBSC is at KBSCorporate.com.

Social Media:

KBS has a LinkedIn page with 18 employees listed on LinkedIn, a Tumblr presence, a G+ page, a Twitter account with 282 followers and a YouTube channel.

KBSC has a LinkedIn page with 220 employees listed on LinkedIn, a Twitter account with 428 followers and a Google+ account.

Information we have on these companies: We have copies of their Terms & Conditions, fees, invoices, signed agreements, quotes, valuation reports and correspondence they've exchanged with previous clients. We have several examples of fees they've quoted to clients (and the fee structure). Some extracts from that information, and snapshots, are reproduced below.

Fees: KBSC generally charge an upfront fee of circa £5,000, but are known to quote higher. On a company with a 2.5m turnover they recently quoted £6,000 (+ 2.5% as a success fee). Our records also show that a £5m t/o business was quoted £7,500 + 3% and a business with a £7 million turnover was quoted £10K + 3%. All figures are before VAT.

The fees for KBS similarly, and to the best of our knowledge, vary from business to business but are significantly lower than the equivalent KBSC charges. The fee structure, however, is the same with an advance fee and a success fee.

Our Summary: From conversations we've had with clients who've used these two companies, the feedback is varied. We've reproduced below a two week extract from our monitoring of the Knightsbridgeplc.com LinkedIn account showing no less than six price reductions over that period. If that rate were sustained over the year it would be 156 price reductions on a listing base of 871 businesses (as per KBS at Daltons in Jan 2018).

It may be the case that their initial valuations are on the higher side forcing later price reductions. However, Knightsbridge have claimed to us that at their initial consultancy meeting with clients the figures they provide are "from both a conservative and aspirational point rather than a specific valuation".

- 06/09/16

- 07/09/16

- 10/09/16

- 12/09/16

- 13/09/16

Company records, director information and financials (balance sheets etc) can be downloaded from the Companies House website:

Knightsbridge Business Sales Ltd, Company Number 08924297

KBS Corporate Sales Ltd, Company Number: 0414155

Reviews

Reviews for these two companies are a little trickier to find and filter partly because of the different names used in referring to them including:

- "KBS" is used in some places to refer to both companies;

- KBS Corporate Sales Ltd was previously called Knightsbridge Business Sales Ltd (!);

- Knightsbridge Business Sales Ltd was previously called KBS Corp Ltd (up to 2014).

This is further complicated by the fact that there's an estate agency and other companies using the letters KBS in their name. As such, note that some of the reviews listed at the below destinations may not be for the company you think but for a different company altogether!

There seem to be no reviews for either company at Reviews.io, TrustPilot, ComplaintsBoard.com, TouchLocal, Scoot, Glassdoor, eOpinions, Feefo or Yelp.

Google seems to be the only location with reviews:

Google (see right column of search results): The company has 27 reviews with an average rating of 4.0 out of 5.

We did however find an article in the Mirror, copy below, where the journalist is not happy with the £995 plus VAT withdrawal fee.

There is a complaint at RipoffReport, but KBS have replied to that and the complaint may have been resolved to the client's satisfaction.

Jobs: KBS often advertises sales positions for sales executives whose responsibility it is to speak with business owners and convince them to list their business with KBS. The last such job is being advertised currently with a salary of £15K - £20K and OTE of £19K - £35K.

Past Financials

In the 2017 accounts, KBS was profitable with a turnover of just under £1.3 million and profit of over £470K. KBSC was also profitable, with a turnover of £5.8 million and profit of £1.5 million before tax. Please see images below.

Market Presence

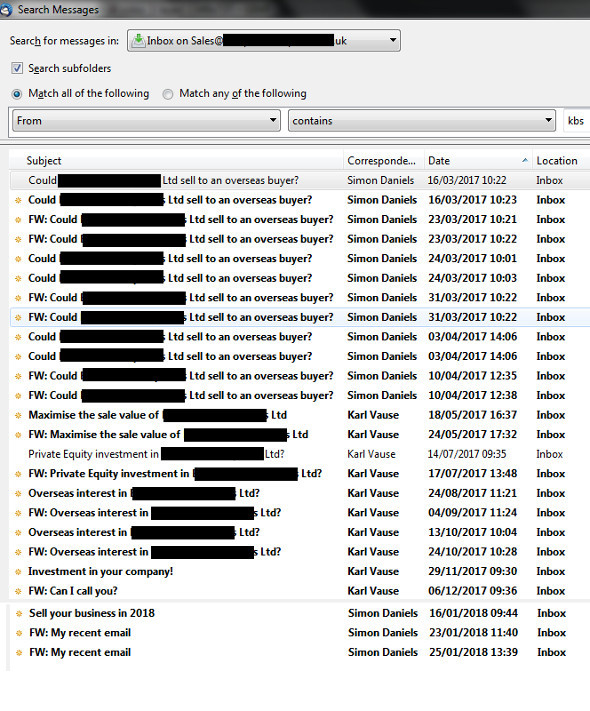

- kbs marketing

- snapshot of mail

Market Presence: The KBS group is one of the UK's largest business brokers by number of listings. KBS has a total of 871 businesses for sale at Daltons out of which 230 are currently showing as "Price reduced". Businesses range in size from some that are below £50K in turnover to one that is listed with a turnover of £856K. There were 50 new listings added in the last 30 days.

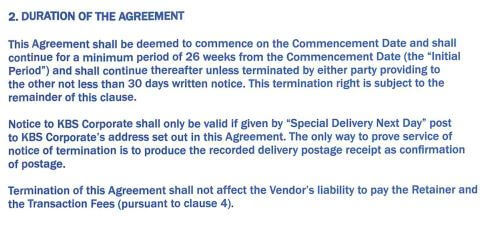

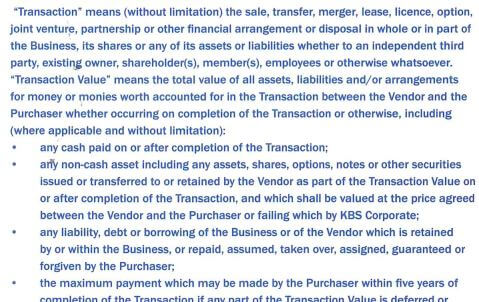

Extracts From The KBSC Contract

As per the above, the contract is open ended i.e. if the business owners fail to cancel the contract in a specific way they will be liable to pay the "success fee" even if they sell their business several years later through their own efforts. Minimum lock-in period, however, is just six months which we consider very reasonable.

2019 Financials

Not that long ago, this company went public and are now listed on AIM as K3 Capital Group Plc. As a public company they are required to disclose a lot more about their accounts than privately held companies. Their detailed 2019 report is available here [PDF]. Some extracts from that, and our observations, are below.

K3 boasts annual sales of £13.6 million, a considerable figure which puts them at the top of several league tables. Out of the £13.6 million, £8.1m was in advance fees and £5.5m was "success fees" earned on successful sale of businesses.

Circa 60% of their income is derived from retainers or advance fees charged. Given that the size of retainers tends to be modest compared with the size of success fees, this would suggest that the large majority of the businesses they take on, in excess of 90% of their client businesses by our calculation, fail to get sold.

K3 member companies charge different fees to different clients based on the size of client business and other considerations. Assuming an average success fee of 2.5% (this is our estimate based on what we know of fees across the group), K3 have sold £220 million worth of businesses in this financial year. That's a significant number and makes them one of the leading brokers in the UK in terms of volume of successful sales (and number of sales).

But if the average sale was £5m (another estimate from us) that makes a total of 44 businesses sold in the year. Again, a big number as deals go, but not so impressive when one takes into account that the number of clients they were trying to sell over the year was circa 1,000.

K3 seem to be quite proud of the fact that they make a lot of money from their retainers. In their report they boast of a "16% increase in non-contingent fee income to £8.1m (FY18: £7.0m)".

Even more concerning is that, simultaneously, the percentage of revenue they earned from success fees has gone down. The £5m they made on success fees this year is a drop from the previous year!

"Due to various issues discussed later in this report, there has been a reduction of Transaction Fee income in the year to £5.4m."

Their current ability to earn more money from retainers may be in no small part to their increased marketing spend - a 9% increase to £1m for the year.

On Page 11, the report explains that the large part of their growth comes from the lower end of the market - smaller businesses. It would appear that larger business - mid market businesses with Enterprise Value of £5m and above - are increasingly going elsewhere (there are 1000+ other players in this market!) and this would suggest a lower performance for their KBS Corporate arm in the year to come.

This is surprising as they claim the increased marketing spend was to attract the larger businesses.

In Knightsbridge Commercial, the number of new clients taken on increased by 20% and the amount they earned on retainers increase by 121% (page 12). In KBS Corporate, earnings from retainers went up by 11%.

On the plus size, all branches of the firm are generating more meetings with buyers and more offers.

Disclaimer: As with any of our reviews we are always willing to make corrections / amendments if any errors are brought to our attention.

2020 Financials

The last quarter of this financial year overlapped the coronavirus lockdown and so would have adversely affected their finances. However, the company has done well financially.

Their revenue was £15m (2019: £13.6m) and retainers were £6.6m (£8.1m)

Retainers form a smaller percentage of their total income this year suggesting they were more successful with selling businesses this year compared with last year.

Note: During the last financial year they acquired two companies - an R7D tax credit claims firm (randd) and a corporate finance firm (Quantuma Corporate Finance). Revenue from these two acquisitions could be skewing the figures.

Your Feedback

Errors & Omissions: If there is any information on this page that you feel needs to be corrected, or other important data that you feel needs to be included, please contact us.