A Detailed Guide To Selling A Business By Yourself & Doing A Better Job Than A Business Broker Would

Everything you need to know about selling a business but which no business broker will tell you.

By Clinton Lee (LinkedIn profile)

There are two ways to go about the sale of a business:

1. The Easy Way: This is the approach that most business brokers use (at least business brokers who handle the smaller, sub £2 million businesses).

and

2. The Smart Way: This requires you to know a bit more, and put in extra effort, but it results in higher chances of a successful sale ... and a better price. (Caution: You can do it yourself but there is no substitute for having an experienced and trustworthy expert assist you!)

I'm going to explain both methods and provide the details you need.

The Easy Way To Sell A Small Business

Heard of RightMove.co.uk? It's a website where houses are listed for sale. Sites like RightMove are usually the starting point for anyone looking to buy property. There are similar websites that list businesses for sale and I've put together a comprehensive list here.

All you need to do is have a look at a few business-for-sale listings at those sites and create a listing of your own. It's simple - write a couple of paragraphs describing your business, decide the price you want and click 'Submit'. Provide some contact details - an 'anonymous' hotmail or Gmail address is good - and sit back waiting for buyers to get in touch.

That's it! That's pretty much what most brokers of smaller businesses do whether they charge nothing up front and work exclusively on "success fees", or they charge a few hundred / few thousand pounds in advance.

What about the valuation and knowing the right price to ask? Prepare to be surprised - there is no secret here. Simply ask for 3 times your profit, or 5 times your profit or 3 times your turnover or whatever multiple others in your industry seem to be asking for their businesses on the business for sale sites.

That's exactly what the broker is doing when he gives you a "valuation"; he's not got some secret valuation calculator! He's simply going by the numbers he sees around him.

Alternatively, ignore all of those numbers and simply quote whatever price you feel you need to persuade you to sell your business.

The above is all that most brokers of sub £2 million businesses do! For that level of service, there is no need for vendors to pay 8% or 10% of the final sale price. Vendors are better off just doing the work themselves and cutting the broker out of the equation.

The Smart Way To Sell A Business

If you've figured that the Easy Way above is not likely to result in many buyers, nor result in the best price, you are correct. As you'd expect, getting a better result involves putting in more work.

To ensure finding the best buyers, getting them in, managing them well, and having them compete on price ... you need to take a far more active approach than the low-end brokers do, and I'll explain all the steps. But before that ...

If yours is a larger business, my advice is to not attempt to sell it yourself. The cost of the right professional is minimal compared with the value they add to the deal. If you are UK based, drop me a note with some basic information about your business and I can put you in touch with the right brokers depending on the size, sector and other attributes of your business.

What is a larger business? I mention £2m in turnover but there are no fixed cut off points. Get in touch if you're unsure, and we can take it from there.

Even if you're selling the business yourself it pays to have someone to advise. And it's highly advisable to have a lawyer and accountant to provide expert opinion and vet the terms of the contract of sale.

Why sell your business yourself?

There are two other good reasons to handle the sale of your business yourself; they are:

a) Over 90% of businesses listed by lower end brokers never find a buyer. I disclose evidence here how the UK's largest broker, KBS (Knightsbridge), hardly sell any of the businesses they take on!

By selling your business yourself, and following the instructions on this page, you have a far higher probability of finding a buyer and completing on a transaction.

b) You'll get a much better price.

And, yes, you can run the sale process anonymously, without disclosing the identity of your business.

In the unlikely event you still feel you need assistance after reading this page, and you are willing to pay for professional help with any aspect of your sale, contact me. But I hope to make this article comprehensive enough to ensure most readers won't need any further assistance.

While there is a lot of information on this page, not all of it is necessary in every case. It is hoped the reader will choose and read those sections below that s/he needs.

1. Business Selling Basics

i) Who is this information for? >>

ii) What does a business broker actually do? >>

iii) Why small businesses should avoid using a broker / transfer agent. >>

iv) The truth about selling the business yourself (without a broker) >>

v) Deciding Price: How much is my business worth? >>

vi) Asset sale vs share sale, which is right for your business? >>

2. Preparing The Teaser, Sales Brochure & EPC

i) What are these documents and why do I need them? >>

ii) Tips on creating your teaser (ie. public listing / advertisement). >>

iii) Tips on creating the sales brochure / Information Memorandum (IM).

iv) Energy Performance Certificate - why you need one & how to get it >>

3. Advertising Your Business For Sale Online

Basics of marketing your business-for-sale opportunity. >>

How to maintain confidentiality while still getting maximum publicity. >>

Where to advertise your business for sale.

Multi-listing Sites (MLS) and how to use them to list your business for sale.

4. Dealing With Buyers & Completing The Sale

Initial response to buyers.

Negotiating the price and the 'deal structure'.

Using a proper legal contract - the Purchase-Sale Agreement (PSA).

1 - Introduction: Business Selling Basics

1 (i) Who is this information for?

This is for the owners of small businesses i.e. those with turnover below two million pounds and / or net profit of less than £250,000. There is no hard definition for what constitutes a "small business", but the smaller you are the more sense it makes to sell your business yourself and without a transfer agent or business broker.

The higher your turnover and profit (or assets on the books), the more sense it makes to start looking for professional assistance. When you reach that stage this is how you go about finding the right broker. Alternatively, you could use my assistance to find you the right broker.

Back to the small, micro and mini businesses. Whether your business is a sole proprietorship, a partnership or a limited company, the method of selling remains the same.

The sector or industry doesn't matter either - high street cafes, beauty salons, dental practices, pubs, building firms, cleaning companies - the fundamentals of selling don't change. And it makes no difference whether you work from home, have leasehold premises or own your own commercial property. We'll cover all of them below.

1 (ii) What does a business broker actually do?

What is a business transfer agent?

What is a business broker? (same thing, really)

In short, these are firms that sell businesses. And we, in the UK, have some of the best business brokers in the world.

Unfortunately, almost none of the best brokers take on smaller businesses, it's just not economical for them.

It takes a long time and a lot of effort to sell a business and smaller business can't afford to pay tens of thousands in fees.

And, for the broker, working on a contingency-only basis (i.e. payment only on successful sale) is a mug's game. Why? Because, irrespective of what your friendly, local broker has told you, most businesses don't sell! It's not worth the broker of smaller businesses putting in a lot of time on every case when only a small fraction are going to generate "success fees".

Brokers who do take smaller businesses on tend to have two methods of charging - they either have a no-sale-no-fee arrangement or they charge a few hundred / a few thousand up-front followed by a "success fee" which is a percentage of the sale price. We discuss broker fees in more depth here with various examples.

Brokers handling the sale of £5m (turnover) businesses put hundreds of hours into preparing each business for sale, getting the right records together and creating a professional Information Memorandum (IM) before launching into the marketing phase. Their marketing alone will cost them tens of thousands of pounds and take literally thousands of phone calls to carefully targeted prospective buyers.

Most brokers of small businesses, on the other hand, do very little. Here's a table showing what they claim to do vs what they actually do.

What Brokers Claim To Do

We'll send an email out to the thousands and thousands of eager buyers on our mailing list to tell them about your business for sale.

We'll run an advertising campaign online to attract buyers.

We get enquiries from buyers which we pass on to you.

We'll protect your anonymity. When buyers show interest they'll come to us first and we'll get them to sign a Non-Disclosure Agreement before disclosing any details about your business.

What Actually Happens

Yes, they'll send this email out. But we aren't talking "eager buyers". This is a list of every Tom, Dick & Harry. They are highly unlikely to be interested in your specific business.

They'll list your business at one or more of these locations. But, these brokers' listings often languish online for years without the business getting sold (there's an example later, with images).

Some brokers do indeed do this. Others are extremely lax and hardly ever reply to queries from prospective buyers.

To be fair to brokers, this service is useful to many businesses who don't want staff & customers knowing the firm is for sale. However, there are other, free, ways to maintain your anonymity (discussed later).

Further Research: Business broker definition, what does a business broker do, how to become a business broker.

1 (iii) Why you should avoid using a business broker.

Why should small businesses (under £2m in turnover) avoid brokers? Several reasons:

1. Brokers operating at this lower end of the market have a terrible reputation. There are the odd trustworthy brokers, but it's very difficult to find them as most brokers are great at coming across as honest and trustworthy.

2. Get the choice wrong and you can end up losing your entire business! There are many examples.

3. As explained above, most are pile 'em high and sell 'em cheap merchants. There is not enough meat in any individual deal for them to devote the time and effort necessary to achieve a quality sale.

.

4. When it comes to small businesses, nobody knows the business better than the owner, and the owner is better placed than any broker to describe the business and portray its qualities and opportunities in the best light. Businesses sold by owners, when properly done, have a higher probability of sale and tend to achieve higher prices.

5. The basic work a broker does - placing an ad online at an MLS site and waiting for enquiries - is not a particularly skilled job. Anybody can do it. Why pay a broker either an advance fee or, worse, a post-sale commission of a whacking great 10% of the final sale price (if the business sells)?

In brokers' favour: All brokers will, however, provide a level of anonymity i.e. they won't publicly disclose the name of the business and will require prospective buyers to sign a Confidentiality Agreement / Non-Disclosure Agreement (NDA) before they are given any details. This is a useful service for most small businesses as they want to keep the news of the sale from their employees and customers.

But this anonymity service is not worth 10% of the value of your business. And there are other, free, ways to protect your business anonymity when looking for a buyer (more later).

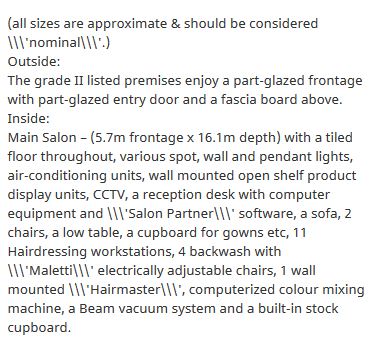

Some examples of businesses that brokers have advertised for sale:

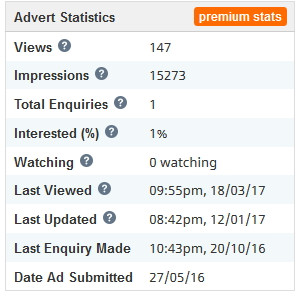

Here's an extract from an ad by broker. They are trying to sell a salon business for £545,000 and haven't even bothered to proof read their description of the business to remove all the slashes! (Click the image below to see the full advert in a new window.)

If you clicked the image above you may have also noticed in the stats section that the ad has been online for almost a year - from 12/04/16 to the 26/03/17 at the top of the page. Yet it has received only 7 enquiries ... and still hasn't sold.

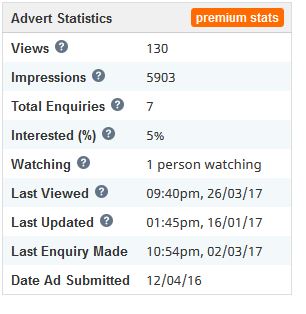

Such a dismal response is not uncommon with broker created listing advertisements! Sometimes it's because of the completely unrealistic price. The below ad is for an online business making a profit of £80K. The asking price is £600,000, more than three times the price at which such businesses sell. The broker is Intelligent Business Transfer, a firm that, in the past, has been a regular offender when it comes to giving clients unrealistic valuations! (Update 2020: Note that the company's got new management since the 2017 advert below and things may have changed.)

Is it any wonder this ad has been online for exactly 10 months to the day this snapshot was taken ...but has had only one enquiry and is still unsold after nearly a year?

click the image to see the full listing (new window)

These are not carefully selected ads, they are the first ads that came up when I did a random search on Rightbiz.co.uk. Examples like these are pretty common - here are some more - and you'll find them yourself if you browse through broker created business-for-sale ads at the main marketplaces. I choose RightBiz for my examples because Rightbiz disclose stats such as number of views and number of enquiries.

Here's one ad for a model agency posted by brokers Turner Butler & Co that has had just two enquiries in well over a year, a sub-contractor business from RTA Business Sales that hasn't sold in over three years, an engineering business from Aspire Business Sales that's been looking for a buyer for years and gets on average one enquiry a year. (Click those images to see them at full size.)

So what can you do to make your ad stand out, to make it a million times better than broker ads, to make it attract more buyers? Simple:

1. Get the price right

2. Get your copy right

3. Get your response right.

Keep reading.

1 (v) Deciding price - how much is your business worth?

There is one great secret to business valuation. The secret is that there is no secret. I've written extensively about business valuation and valuation myths, but the reality is that there are a million different ways to calculate value and each will give you a different number. So, my advice is to ignore them all.

It's a cliche that a business is worth only what someone is willing to pay for it.

It's more accurate to say that a business is worth only what you can convince someone to pay for it.

The value of the business lies not in what you're putting on the table but what value you can convince the buyers it can deliver for them (more). And this is another reason to not use a transfer agent / broker. They will not invest the time to learn enough about your business to actually pitch it well and sell it. Nobody can sell the qualities of your business like you can.

But if you intend selling your business you likely want some idea of what number to use as an asking price. And we'll come to that. But it's important to realise that there is no definitive way to arrive at the value of a business. Further, the value of a business is not expressed in a number. The value is a package and you can read about these packages - or deal structures - here.

Many business brokers offer "free valuations". I've discussed business broker valuations here. Avoid these valuations like the plague. No, the number isn't more credible because it came from a broker. In fact, it's even more likely to be a completely dud, pointless, random number. Avoid, also, the various online business valuation tools, they are not what they seem ... and they present a major security risk.

There are many ways to get more reliable figures. You could a) speak with your accountant and ask him to give you a rough idea or b) hire a qualified, professional valuer or c) do a bit of leg work to research how much businesses like yours are selling for.

I prefer (c) partly because it's free, it's real and it's based on the market's current appetite for businesses like yours. No other method comes even close to this as a predictor of price.

How do you research prices in the market? Have a look at the list of marketplaces we've assembled for your convenience. The top ones like BusinessesForSale.com, RightBiz.co.uk and DaltonsBusiness.com have thousands of businesses currently advertised on their sites. And these are organised by sector / size / geographic region etc. Start collecting numbers (covered in more detail below) and plug them into a spreadsheet. Example (click image):

Yeah, I know, it's hard work. But it's work that will give you a better idea of what's a good price for your business. Go to market at too low a price and you could be shooting yourself in the foot. Go to market with too high a price and you will scare away good buyers and permanently damage your chances of selling.

So, do the research! It's worth the time and effort.

Shortlist several businesses advertised on those sites - the larger the sample, the better. Pick ones that are not just in your industry but close to yours in turnover / profit i.e. business roughly the same size as yours. Save or bookmark those business-for-sale listing pages. Then start plugging numbers into your spreadsheet - numbers like their turnover, profit and asking price... and how long each business has been online.

Before long you'll have a good idea of the type of prices people are asking relative to their profit. You might find that in your industry people are generally pricing their businesses at 3x their annual profit. Or 5x their annual profit. Or some other number altogether. But you'll have a number that's relevant for businesses in your sector, a number that is based on current market conditions, a number that is far better than the exaggerated figure you'll get from a business agent.

But, make no mistake - these are asking prices, these are not prices at which businesses have actually sold. And asking prices can sometimes be very silly indeed.

So let's find the silliest ones and remove them from your spreadsheet altogether. How do you know which ones are silly? Well if the business has been on sale for several years and has still not found a buyer, it's safe to say that the price isn't right. Let's remove those.

Let's go through those business-for-sale listings again and check for dates - sites like Rightbiz tell you the date the business was first listed for sale. Which ones on your list have been on the longest? It's safe to strike them off your list and ignore the prices (multiples) at which they were listed. Businesses are obviously not selling at those prices!

Now that you've cleaned your spreadsheet you have a good idea of your "competition" i.e. businesses like yours competing for the same buyers. And you know what their price expectations are (expressed as a multiple of profits). Now multiple your profits by that same figure and you know what equivalent asking price for your business would be seen as reasonable by buyers.

Recipe for failure: Going to market with whatever your gut tells you about your business worth is almost guaranteed to end in failure to sell. In cases where the business is not making a profit, going in with the expectation that someone will pay you at least what you've invested in the business ... is a common mistake but it's highly unlikely you'll recover those costs.

There is one other pricing mistake vendors of small businesses often make. They come up with arguments such as "the buyer only needs to add some marketing and they can make double this profit" or "the buyer just needs to use social media" or "the buyer just needs to do some SEO". Don't tell the buyer what to do and don't price your business on these imaginary performance increases!

If you can't implement that idea and prove that it works ... then dismiss the idea, it doesn't add to the value of your business!

At this point business owners often argue that their business has "potential" and should therefore command a higher multiple. What I have to say about potential is on my valuation myths page. In short, my experience is that every seller claims "potential" and buyers usually tune out any mentions of this word.

But if you feel there your company has some special potential, and that your business should command a price much higher than the multiples that similar businesses are selling for, my recommendation is that you do not attempt to sell your business yourself.

Getting a price that's out of kilter with the market or a price "based on potential" is not an easy task and not one for an amateur. If there are some unusual / different / exceptional factors at play that justify a higher price then you'll be well served using professional advice. I do offer this advice, but that's a paid service I'm afraid. You can contact me here.

Further research: how buyers are valuing businesses, some business valuation basics, what's the right asking price.

1 (vi) Asset sale vs a share sale

There are technically two ways to structure a transaction - the share sale and the asset sale. While this might appear like accounting mumbo-jumbo - a sale's a sale, right? - it's worth recognising the difference and the pros and cons of each.

As you'll be aware, the end of year balance sheet for a typical limited company typically has some assets and some liabilities. Common assets are stock, vehicles, machinery and tools, IT equipment etc. These are "physical" assets. There are other assets such as accounts receivable (people who owe the business money) and cash in the bank. What many small business owners forget is that the business also owns assets which don't appear on the balance sheet - trademarks, reputation, licences, copyright and patents etc.

The balance sheet also has several liabilities. These will be items such as loans the company has taken out, bills yet to be paid, the overdraft etc.

When the time comes to sell the business you've got two choices:

1. You can sell the whole legal entity that is your business - the complete package of assets and liabilities. The new owner will effectively step into your shoes. This is known as a share sale. It is done by you transferring all your shares in the business over to the buyer. The transaction is between the buyer and you (not your company). Payment will be made to your personal account (not to the company bank account). Once you've sold the shares you'll no longer have any connection with the business. A share sale is the simplest from your point of view. But there is one other way ...

2. You can sell just the assets. In this scenario, the assets of the company transfer to the new owner and all the liabilities of the business are retained in the business. The deal is between the investor and your company (not you). The money will be paid into the company's bank account (not yours). After the sale you'll still be the owner of the business but it will be of a business that has little to no assets. It will still have liabilities though! You can use the money in the company bank account to clear the liabilities - pay them off - and apply to Companies House for a striking off (a closure of the company).

Buyers prefer to purchase assets rather than shares. Sellers prefer to sell shares as that is cleaner for them and more tax efficient.

In every deal it is up to the seller and buyer to come to agreement on whether it will be as asset or share sale.

Notes:

1. In an asset sale the seller typically sets the price to be beyond the total value of assets that appear on the balance sheet. That's because not all assets appear on the balance sheet. "Intangible assets" such as goodwill, trademarks, patents, website, customer database and all the other assets that are intangible and can't be touched or felt aren't included in the B/S and the value of these assets, too, needs to be included in the price. The price the seller gets - if they've built value in the business and made it an attractive target for buyers - will be large enough to pay off all the liabilities and leave a nice chunk for the owner.

That amount, rather than any headline price, is what should be important to you in any negotiations with buyers.

2. Caution with asset sales: Don't assume all assets are transferable. Assets like social media accounts, Amazon / eBay seller accounts etc., are usually not transferable. If going for an asset sale the buyer will consider these assets worthless as he can do nothing with them ... and that will affect the price the buyer is willing to pay.

3. When you sell the shares of the company, the money you get benefits from various tax concessions and you may not need to pay any tax on it. (Speak with your accountant about Entrepreneur's Relief and about your CGT allowance.)

We've got an article examining in more detail the pros and cons of a share sale vs an asset sale.

2. Preparing Your Teaser, Sales Brochure & EPC

2 (i) What are these documents and why do I need them?

You need to prepare two documents - the advertisement (teaser) and the Information Memorandum (also called the Confidential Information Memorandum or Sales Brochure). And most businesses also need an EPC - you need to hire an accredited assessor to issue you with an Energy Performance Certificate (EPC).

The advertisement is also known as a "teaser" or your "business-for-sale listing". It's the information about the business that you see in public when you browse the various places where businesses are listed for sale. If you visit those sites and click through to a few of the businesses for sale you'll note that most of these businesses do not disclose their identity - they do not mention the business name - but they do disclose a lot of other information about the business. These teaser ads or "listings" are designed to get prospective buyers to contact the business seller for more information.

If using a business broker, it's the broker who creates these ads/listings for you. And nine times out of ten these will be dry, insipid ads that actually turn buyers off rather than motivating them to get in touch. But as you're going to be creating this ad yourself, you can do a much better job. Vendors usually take the time and trouble to create an ad that stands out and grabs attention (unlike the broker-created ads I've demonstrated above).

The next section provides links to give you all you need to know in order to create an exceptional ad that attracts buyers to your business.

2 (ii) Tips on creating your advertisement / teaser

The same principles that work for other adverts work here, too. However, you are limited in that you are relying on copy rather than colourful visuals as most business for sale ads are text based. So you need to make sure the copy is:

- concise

- informative and

- attractive

- professional

You need to disclose some information about the business, yes, but at this stage it is normal to not disclose the name of the business or give clues that will allow readers to reverse engineer the identity of the company / firm behind the ad.

But the more information you disclose about the business, the more likely prospective buyers are to bookmark your listing and/or contact you to find out more. The type of information you can usually safely disclose include turnover, profit, the sector or industry the business is in, number of staff, details as to whether the premises are leasehold or freehold etc.

Rather than reinvent the wheel and explain in great detail what makes for a good ad, I'm going to link instead to some fantastic tips others have put together on the creation of an effective listing.

Forbes: Ten Commandments Of A Business For Sale Listing

YouTube: A Video With Examples Of Good Ads

BizJournals: 5 Tips To Make Your Business For Sale Ad A Winner

bSale: How To Write A Business For Sale Ad

Business Broker.net: Writing An Effective Business For Sale Ad

BizBuySell: 5 Reasons Why Your Business For Sale Ad Is Getting No Responses

Others: 1 | 2 | 3

2 (iii) Tips on creating your Information Memorandum

The Information Memorandum (IM) is a key document, its purpose is share with the reader key information about your company, get them to engage and get them to make an offer or raise questions. As you'll appreciate, a bland A4 page with very little useful information is not going to impress buyers.

If you are creating your own IM you have a vested interest in doing a good job and presenting your business well. And this section is going to tell you exactly how to do that.

IMs are known by many names. They may be called Confidential Information Memoranda, Sales Brochures, Pitch Books etc ... but these are all the same thing. They are documents that present the investor with information about your business.

Remember three things about preparing IMs:

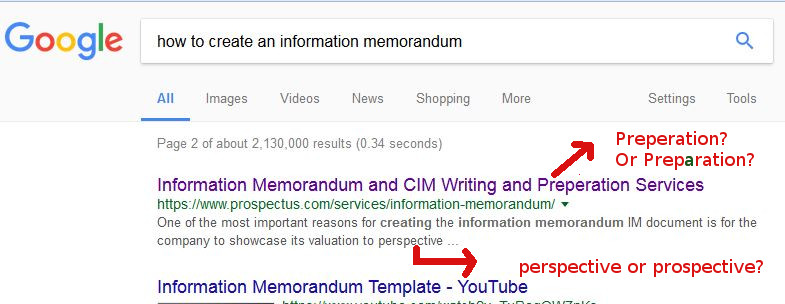

a) Keep it professional, check grammar and spelling. Not like these so called "professional" CIM writers below!

b) incude all the information buyers expect to see in an IM and

c) keep the tone neutral and resist the temptation to talk up or "sell" your business.

Remember, this is an information document, not a sales pitch. This is where owner-sellers have the greatest difficulty. They are so used to talking up their product / business that they struggle to present a neutral view. It may be worth getting a third party to vet your document for tone.

Some good articles on preparing an IM:

What's in a CIM?

2 (iv) Energy Performance Certificate - Why, How, Where

This section coming soon.

3. Advertising Your Business For Sale Online

Basics of marketing your business-for-sale opportunity

This section coming soon.

How to maintain confidentiality while still getting maximum publicity

For many (most!) small businesses keeping private the fact that the business is for sale ... is a big concern. If staff, customers, suppliers and others become aware that your business is on the market it could have a negative impact on the business. Competitors could use this as an opportunity to tempt your staff / customers away. Even if they don't, staff could get nervous about the future and start looking around for another job. Customers could drift away.

For a few businesses, especially those without staff and without regular, "repeat" customers, confidentiality about the business being for sale may not be a big concern. However, confidentiality is still required to protect financial information, competitive advantages, unique deals currently enjoyed with suppliers etc.

So we split confidentiality into two sections:

i) keeping secret the fact that the business is for sale - the opportunity confidence - and

ii) protecting internal business information from the wrong people - the data confidence.

There is an obvious conflict between getting maximum publicity for your business-for-sale opportunity ... and maintaining confidentiality.

This section coming soon

This section coming soon.

This section coming soon

This section coming soon.

Got a question about selling a business that's not covered on this site? Get in touch and let us know what it is.

4. Dealing With Buyers & Completing The Sale

This section coming soon

This section coming soon.

This section coming soon

This section coming soon.

The Reality Check

Irrespective whether it's a broker handling your sale or you doing it yourself, most sellers of small businesses are often unaware of the harsh realities of selling a business. Please read about them here before attempting to sell your business.

Have a question? Like to speak with an expert?

Provide your details in full confidence and we can arrange a call.