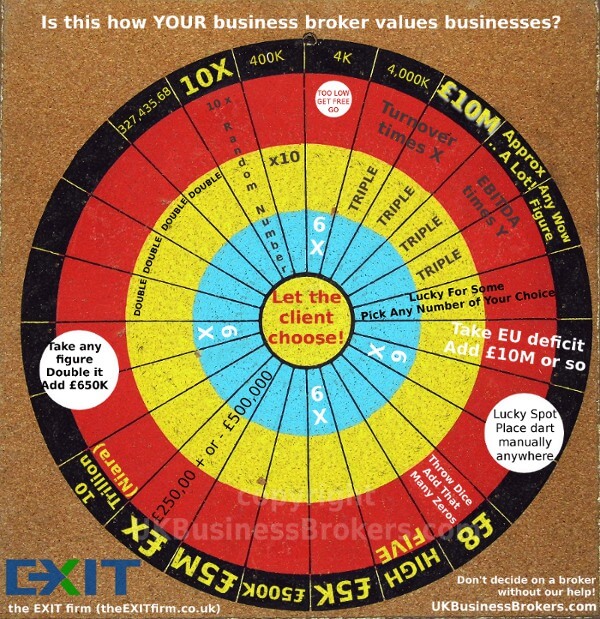

Is this how YOUR business broker values businesses?

For many businesses, a business broker is the first port of call to get an idea of how much their business is worth. That's not necessarily the best place to start.

There are three reasons:

- Brokers are generally not qualified valuers and this is not their area of expertise;

- They have incentive to over-value businesses in order to get your instructions;

- The only valuations worth anything are those made by people who have the money and intent to buy your business.

Free Business Valuations

Most business brokers will provide a free valuation for your business. Just like estate agents will give you a free valuation on your house.

But there's a difference. You can get a rough idea of whether the estate agent's figure is reasonable by examining how much other houses in your street have sold for recently.

Not so with businesses.

There is no national registry tracking business sales and there is no record of the prices individual businesses obtained in the market. And these figures are impossible to work out from published accounts.

Why The Free Business Valuation Is Worthless

You have no way of verifying whether the broker is anywhere near right. And most brokers talk a good game, explaining that their many years of experience gives them the ability to predict value with a high degree of accuracy.

Not necessarily true!

They may justify their figure with some industry statistics on "going multiples" or some jargon on Net Present Values and Discounted Cash Flow methods for calculating the worth of a business.

That's a lot of bunkum.

They could be out by 10%, out by 50%, out by 90% or out of the ballpark. And they usually are. That's why they'll make no guarantees about you achieving that price. The closest they'll come to a guarantee is the no-sale-no-fee deal i.e. "we are so confident that we can get you this price that we'll charge you nothing till the business is actually sold".

This is a trap as explained here!

Besides, buyers and investors are hardly going to rely on a valuation done by your agent. If the valuation is of no use to you in deciding asking price ... and no use to the buyer as a guide of what to pay, no real purpose is served by this valuation.

The Bad News

If you've had a broker value your business, start by throwing the valuation away. Here's my recent experience with valuations I've seen by brokers.

Broker Name | Broker's Valuation | My More Accurate Valuation |

|---|---|---|

Intelligent Business Transfer | £400,000 | Under £50,000 |

Intelligent Business Transfer | £50,000 + Stock At Value | Worthless business |

KBS (Knightsbridge) | £1,200,000 | £100,000 - £150,000 |

KBS (Knightsbridge) | £400,000 | £0 |

Blacks Business Brokers | £200,000 | £10,000 (if lucky) |

National Business Sales | £250,000 + Stock At Value | £50,000 (or just the "distressed" value of the stock) |

Turner Butler | £500,000 | Under £10,000 |

National Business Sales | £150,000 | £0 |

Hopefully, you get the picture. While it's difficult to accept that your business isn't as fantastic as you thought, when something looks too good to be true it usually is!

So chase the unrealistic broker valuation and you'll simply find that you're wasting your time.

Another Reason Why The Free Valuation Is Meaningless

But there's another reason why any figure the broker gives you is not worth the paper it's written on, and to demonstrate I offer to buy your business for double whatever the valuation figure you currently have.

Read our other articles on business valuation here. And about how you can get a price that's far in excess of your valuation.

So How Do You Go About Getting A Realistic Valuation?

Go to your accountant! And if he can't value your business, he'll be able to recommend someone to value the business for you. Bear in mind that you'll probably have to pay a qualified valuer. Yes, if you want a proper, professional opinion you'll have to pay for a professional.

And, no, there's no "rule of thumb" way to value a business. That's a myth. Like several other so called methods.

What Can You Do If You've Been The Victim Of An Inflated Valuation?

You have a case against them for deception and a legal precedent (more below).

Where someone claims to be an expert and proceeds to provide a business valuation service and, in stating their experience in the industry imply that they are experts in this field, they are making an implied statement of fact to the effect that “I have reasonable grounds for the opinion I am giving”."

Esso Petroleum Co Ltd v Mardon [1976] EWCA Civ4.

You can sue them for a refund of the retainer you paid.