10 Things You Really Must Know

About Business Valuation

There are many myths surrounding valuation as it relates to small and micro businesses. This post attempts to dispel the more common ones.

Businesses are not worth a "multiple of turnover"

Business are not worth a "multiple of profit"

There is no such thing as an "accurate valuation" for a business

The buyer can't "just add marketing" and make a lot of money

You can't rely on business brokers to give you a realistic valuation

The multiples that listed companies sell for ... have nothing to do with your end of the market

Buyers don't lay any store by the valuation your agent has done for you

Don't kid yourself on profit, you're possibly making much less than you think

Businesses aren't valued based on their "potential", potential is irrelevant

The value of your business is not expressed as a number

Businesses are not worth a "multiple of turnover"

Many small business owners believe in valuation "rules of thumb". For example, they believe that you can arrive at the "real" or approximate value of a business by taking the turnover and multiplying it by a certain number.

There is absolutely no logic to this "method" of calculating value. If this is how buyers calculated value, they'd go bust very quickly. It would be a walk in the park to add millions of pounds of "value" to any business. Simply sell an item to someone, buy it back at the same price, sell it to them again, buy it back and keep repeating the process till the turnover increases to the desired level!

In very rare cases, where the turnover is the same as profit (a one man accountancy firm, for example), it could be argued that the base used for the calculation was the turnover, but that's stretching the truth a bit.

There is one other exception, and this is sometimes seen in the tech sector, where turnover is used as a proxy for market share. So a company with a £100m turnover in a £150 million market could be said to have the lion's share of the market.

That gives them a major competitive advantage. Where a company has such a major market share, turnover, or rather the percentage of the market that the firm commands, is taken into account (along with other factors).

Bottom Line: Buyers aren't stupid. They don't pay a multiple of turnover.

Businesses are not worth a "multiple of profit" either

Another myth is that businesses are worth a multiple of profit.

"Simply take your last year's profit and multiply it by a magic number and voila, you're got a valuation for the business." Not so!

There is no logic to this "method" of assessing value either. In this case it's not because profit (or EBIT, or EBITDA or Seller's Discretionary Earnings) can be easily manipulated. Well, it can.

But the reason profit can't be the sole determinant of value is this: two companies with exactly the same profit generating ability may have vastly different asset profiles.

One may own no fixed assets worth mentioning and the other may own a property worth several million. So the latter has something of considerable value in addition to the earnings; it will therefore command a much higher price in the market.

Another reason: Two businesses in the same industry presenting exactly the same numbers in the balance sheet could have vastly different prospects.

One could be a business with healthy historical growth and a sound management team. The other could be on the way down with heavy dependence on the founder / owner. The former might attract offers in the region of 5x their profit while the latter might struggle to sell at 1x.

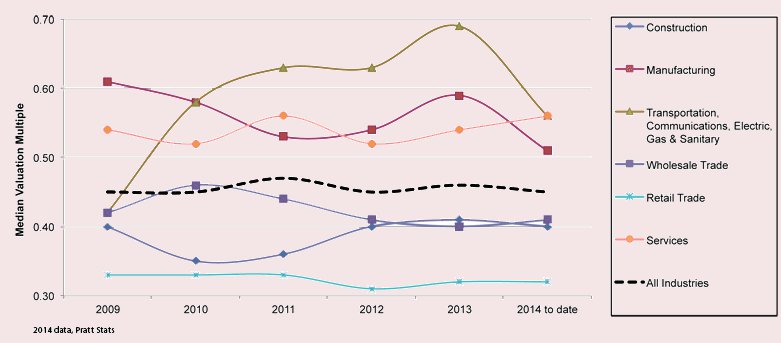

There are often "multiple of earnings" graphs created like the one below showing median multiples. Did the buyers of these businesses take the earnings figure and multiply it by a certain number? No!

When you see price expressed as a multiple of earnings, that's likely a calculation done by a third party after the deal was closed. The negotiators involved in the deal didn't negotiate "multiples"!

As you'll notice, the multiple seems to be related to industry. In some industries the multiple seems to be higher than in other industries. But this is an illusion. First of all, these are median figures and they provide no guide as to the full range of multiples offered in each industry.

Secondly, bear in mind that some industries have higher infrastructure costs than other industries. Manufacturing businesses, for example, tend to have higher net profit margins than retailers. So the higher "multiples" here reflect the higher value of net assets in the business.

That someone has paid 3x for a competitor of yours provides no indication as to what your business is worth. Your business could be worth 10x your last year's earnings. Or 100x your last year's earnings (if last year was a particularly bad year and unlikely to be repeated).

Or your business could be completely worthless! Yes, that's possible too.

As mentioned before, profit is only one component in the calculation! You can't value a company based purely on the profit it's making.

Bottom Line: Sorry, there's no easy way to work out the value of your business and anyone who gave you that impression was lying.

A note about "gross profit": When I mention profit above, I'm talking about net profit after all expenses. I know, I know, the gross profit figure is a bigger number, and a bigger number is always better, isn't it?

Except that buyers aren't interested in GP. They are not interested in what the business makes, they are interested in what they get to keep. As would you, to be honest, if you were buying a business rather than selling one. Don't mention gross profit.

There is no such thing as an "accurate valuation" for a business.

There is no such thing as an "accurate" valuation simply because there are hundreds of ways to value a business ... and all of them are valid. Some examples:

The "book value" of a business is derived from the balance sheet. No complicated calculations are involved - simply call up your last submitted accounts and subtract liabilities and intangible assets from the total assets to arrive at the book value or the "net asset value".

An alternate method involves predicting cash flows / income that the business will generate over the next few years and calculating a value based on that. Using this method, the value of the assets don't come into play because their value is already reflected in the income those assets are generating.

Using the former "asset based" valuation method wouldn't be fair to service businesses as it's possible for service businesses to generate millions of pounds of profit with just £50K or less in assets. Conversely, an "income based" valuation method wouldn't favour a property firm that has millions invested in real estate but generates just a small profit.

So, why not use a mix of asset and income based valuation methods? People do. But that then introduces a subjective element - what weight do you assign to each method? Depending on the weight assigned you end up with not just two possible valuations, but pretty much any figure you want that falls between those two valuations!

For a given business if you can get hundreds of different valuations using just those two methods, you could get thousands of possible valuations once you throw a few other methods into the mix and start adjusting for all the subjective factors that get introduced.

Bottom line: Even courts can't agree on one fixed method to value businesses and they take decisions on a case by case basis. Each potential buyer of your business will use his own method to calculate what he thinks the value of your business is. And every valuation so conducted is just as valid as any other!

The "just add marketing" myth

Business owners often argue that their business could make a lot more money with just one simple input.

It's usually marketing. "Just do some more marketing and this business could make five times the profit it's making now."

And, based on that, they expect a higher price for their business.

That's not how it works. If you think marketing will make a difference, you need to prove it. You need to demonstrate hard figures. How much of additional profit is generated per £1 of marketing? That's what buyers want to know.

If you don't have the marketing skills to prove it then buyers have no way of knowing whether £1 of marketing will generate £10 of additional profit or whether it'll generate only £0.50p in additional profit. In the latter case throwing money at marketing is actually a losing proposition.

Even if you've proven that £10K in marketing results in £11K of additional profit, buyers will not assume that £20K in marketing spend will result in £22K of additional profit. If you wish to argue that your results are scalable you'll need to prove that they are scalable.

Similarly with other "simple" inputs. To your buyers there is no simple input that will increase profit.

See, also, the myth about "potential" below.

You can't rely on a business broker to give you a reliable valuation

Any business owner who has spoken with a business broker or a business transfer agent will likely have been offered a free appraisal for their business. This is usually a fixed number or quoted as a multiple of turnover.

We've covered business valuations by brokers and how they can be misleading elsewhere on this site.

A few brokers, very few, do have the in-house expertise to conduct valuations, but they generally won't do it for the smaller sub £1m businesses as it takes considerable time to analyse the books and other variables to come up with even a rough guide to the "range" of offers the business might get when it goes to market.

Yes, it takes many hours, sometimes more than a day, and it's still not an "accurate valuation" as it's not backed by an offer to buy your business!

Some business brokers have "valuation tools" on their website. These are extremely dangerous and I've warned about them before.

These valuations tools are usually not what the broker has developed in-house but some tool developed by a third party such as Biz Equity or John Warrilow's "Value Builder" system. While you may think you're getting a valuation at the business broker's site, in reality all your data is being sent to an unknown third party's server, based in some other country, for their algorithm to do the calculation!

And despite the risk, you don't actually get "an accurate valuation". You get just another wild guess number.

Bottom Line: Yes, you can get free valuations from brokers, but the large majority of such valuations are pie-in-the-sky figures and can't be relied upon. And the ones that are not pie in the sky numbers are risky as your highly confidential data is being sent to an unknown third party.

The valuation multiples (P/E ratios) of large firms in the industry don't apply to yours

People often quote multiples achieved by large, publicly traded businesses in their sector and fool themselves into believing their own business is worth a similar multiple. In fact, business brokers often quote these public examples as justification for the unrealistic valuations they routinely hand out.

Here's why there's no connection between the multiples those companies sell for and the multiples you're likely to attract.

Large firms have a moat around them - a moat that protects their position in the market. MacDonalds' moat is the sheer strength of their brand. For internet backbone providers the moat is the mountain of capital required to build a network of cross-Atlantic fibre optic cables; this acts as a "barrier to entry".

For some online firms - from eBay to Facebook - the huge market share they control (partly as a result of their first mover advantage) is a significant moat for a competitor to take on.

A moat presents two competitive advantages. First, it allows the company to make oversized profits in their sector. Second, it reduces the risk profile.

The importance of that second factor cannot be overstated. Risk is a big influence on valuations. Not risk as perceived by the seller, but risk as viewed (and quantified) by the buyer. The greater the risk the buyer sees in a company continuing to grow and increase profits, the lower the multiple he'll be willing to pay.

Let's move our gaze right down the food chain to firms that are only a bit larger than yours. If there is a competitor ideally matched to your business in every respect except that they boast double your turnover and double your profit, they'll still command a higher multiple than your business would. Their size itself adds to their appeal. Bigger is better in M&A. For some trade buyers acquiring your business wouldn't make an appreciable difference to their profits and balance sheet. But if they bought this competitor of yours it would "move the dial" so to speak.

Buyers don't make offers based on the valuation done by a business agent

No buyer who has a modicum of sense would rely on a valuation conducted by a business broker who's engaged by you, the seller, and being paid by you.

Buyers will collect detailed information about the business and form their own opinion on value, usually with the help of professional advisors.

They don't like dealing with unrealistic sellers. If there's a large disparity between your asking price, based on your broker's valuation, and their own assessment of what you're worth ... they may simply walk away and not bother engaging.

Bottom line: An inflated valuation put together by an over-enthusiastic (or unethical) broker could lose you valuable buyers.

Don't kid yourself on profits, your business is probably not making as much as you think

Small business owners usually underpay themselves because there's a tax advantage to taking only a small salary and taking a larger amount in dividends.

While that's a cushy little tax advantage we UK-based small business owners have, we shouldn't fool ourselves into thinking that the profit we declared was all "real" profit.

Let's say you've been working 60 hour weeks, paid yourself £10K a year and declared £25K in profit. A buyer would recalculate your profit. He'd work out how much that 60 hours of labour was worth - how much he'd need to pay someone with your talents to do that job.

If he can get that covered at £12 an hour (including national insurance contributions etc for any employee/s he takes on). ..it'll cost him £12 x 60 = £720 a week. Or nearly £40,000 a year.

Your "profitable" business, far from being profitable, is actually losing money!

Most buyers would walk away on this realisation.

Some business vendors try to argue that the buyer could do the job himself and save the cost of an employee.

That's a somewhat naive argument as it assumes investors are looking to pay good money to buy themselves a job. If your business is going to pay him just a salary for his time, he's getting no return no the capital he invested and no compensation for the risk he's taking with buying a business!

Why would someone pay money to buy a job, a job that has unlimited working hours, doesn't give holiday pay, doesn't have any employment rights and which he can't quit without losing a large chunk of money (the investment made)?

There are people who'll buy a job - illegal immigrants, for example, who can't get a real job because they don't have the right paperwork. And a few other desperate characters. But these are the exceptions rather than the rule.

Bottom line: Make an honest assessment of what it would cost someone to replace you ... and deduct that from your profit before declaring your profit to a buyer. Don't do that and you'll end up looking more than a bit silly (and, possibly, a bit shady).

The "my business has great potential" myth

Buyers are not going to pay more for the potential of your business.

In my 35 years of business I have never come across a single seller who didn't claim his business had "great potential".

Buyers are sick to death of hearing the word potential.

As far as a buyer is concerned if the business has so much potential you'd be exploiting that potential yourself and growing the business, not making excuses about why you can't.

So even if there really is potential in your business, you can bet your last penny that the buyer is trying hard to filter out everything you're saying about potential.

There's another way of looking at this: Every single business has potential. The domain Google.com once had potential. It was sitting there waiting for someone to buy it for $5. Nobody did. Till Brin and Page bought it and built a search engine on it.

Should Brin and Page benefit from the fruit of their efforts? For the potential they exploited and monetised? If yes, then surely any potential in your business is not to your credit. The buyer will need to invest time, money and skill to convert that potential into pounds. All credit should then, as with the Brin and Page example, go to the buyer. Why would he pay you, in advance, for the improvements his efforts are going to generate?

There are ways to play potential to your enormous advantage as I advise my clients, but do not expect to claim potential, in your discussions with buyers or documents you submit to them, and expect your buyer's offer to be higher.

Claiming potential has exactly the opposite effect! It reduces the price you get.

Don't think of valuation as a single figure

It's very rare to get an all cash offer for your business. Offers are usually a package of part cash, part promise to pay in the future, part lots of other things. And it's a balancing act. Make a concession in the amount of cash you want upfront and you could extract a higher price in exchange for that concession.

We cover deal structures in this post.

Just choosing to sell the business's assets rather than the business's shares can add as much as 100% to the price (as we explain here).

Bottom line: The value of your business is not in a number but in a deal.

Yes, there are ways to obtain a price in the market that's far in excess of any paper valuation

In fact, we've got a whole ebook on the subject. Subscribers to our email newsletter get it for free. Subscribe here.

And if you really are generating a decent profit, get in touch to discuss how best you can use that to your advantage in getting top price for your business.