How To Deal With £1 Charlies From The DealAcademy (& Other Fake Business "Investors")

£1 Charlies are business buyers who pretend to be funded buyers but who use a variety of tricks to take ownership of your business virtually for free, without investing any of their money, and usually by cheating you! Be warned, £1 Charlies can be very sophisticated in their execution!

This article is a collection of material from my LinkedIn posts and some additional text. It uses "tips" taught from a one of the numerous companies running courses on "how to buy a business. This one is called The DealMakers Academy (TDA) and it's owned by an ex-marketer turned "M&A guru" called Jonathan Jay (review). TDA runs courses teaching people how to con you. I pick a few examples of what's taught and, importantly, I'll suggest ways you can protect against them.

BUT THERE'S NOTHING WRONG WITH THE £1 DEAL!

In principle, no, there's nothing wrong with the £1 deal. If your business is a distressed business, or insolvent, a buyer may offer you £1 and ...well, it's probably a fair deal.

However, £1 Charlies are not looking for distressed businesses. Typically, they're looking for solid, established, profitable businesses that are worth a lot of money. They approach the business owner pretending that they are funded, that they are wealthy investors, and that they have an interest in buying the business. However, their goal isn't to invest their money at all!

It's about using other people's money - loans, credit etc. And there's nothing wrong with that either ...if you, the seller, get your money! But you won't. More later.

These people have a lot of sophisticated ways to wrest the business from you without paying for it! They have "structured deals" and "consultancy agreements" and all kinds of other clever and crooked tricks up their sleeve. If you don't know what the tricks are, you will fall victim to them! You will lose a lot of money. You may lose the entire value of your business!

THE MODUS OPERANDI #1

One type of "structured deal" often proposed by £1 Charlies is where they offer part of the purchase price up front and balance in instalments (deferred payments), and they'll offer you security for those deferred payments. That all looks very good, but here's here's where it gets interesting!

The money they are paying up front is yours, not theirs! They intend to borrow it using the assets of your business as security - YOUR stock, YOUR debtors, YOUR other assets! They want to put in not a penny of their own money. It's not even them borrowing the money, it's your business borrowing the money on the date of the business sale transaction.

But that's okay, you're getting your money, right? Wrong.

They'll borrow money in the name of your business to pay you an advance, not the whole amount, and then they'll offer you your now heavily debt laden business as security for the balance.

Seriously!

So, effectively, they've invested none of their money, they now own your business, you've got a small payment (that you could have organised yourself if you wanted to borrow against the assets of the business) and you've got some pretty worthless security for the "deferred payment" loan you're giving the buyer!

If the buyer has no skin in the game, if he's not got a substantial sum of his own money at risk then, quite simply, he's worth avoiding. Most deals with these parties never get to completion. You'll spend a lot of time, and probably end up paying fees to lawyers etc to draw up contracts, and you will lose all of if (when!) the deal collapses. These deals are notorious for collapsing before you get to completion, because of the numerous lenders and other parties involved any one of whom could pull out and jeopardise the completion!

THE MODUS OPERANDI #2

Deferred payments is not the only way they "structure" deals to their advantage. In talking about a hypothetical business that's worth £300,000, the below mentioned podcast advises buyers to structure part of the deal as a regular consultancy payment to the seller.

They suggest that students offer to pay part of the purchase price in the form of a "consultancy fee". The idea is that if they've agreed, say, £500K for the business, they should pay a small amount, say £50K, in cash and pay the rest in the future via employing the business owner as a "consultant", whether or not that person continues to provide any service to the business.

DealAcademy says to its students to tell vendors, "Let's say there's a consultancy fee where we pay you £500 a day and we pay you for a day a month for the next 3 years ...that's £18,000....Let's make it a bit more exciting £2,000 a day ... that's £75,000".

Then they advise their students, " ... don't forget you're not obligated to use the consultancy, it's a consultancy agreement that can be terminated by either side".

Wink, wink.

So, effectively, they're offering to pay 90% of the price, in a post sale arrangement, in the form of a regular consultancy fee but one in which the small print says they can terminate the agreement and stop paying the seller whenever they want!

"(It) can be terminated by either side". They'll make a big deal about the "either" being fair. But as a seller you have no incentive to terminate an agreement where someone has promised to pay you money! No, it's not "fair" that it can be terminated by either side.

What are the chances that a buyer will continue making a regular payment for the next 3 years when he can terminate the agreement at any time, without any reason, after ownership of the business is transferred to him? I reckon it's close to zero.

THE MODUS OPERANDI ...To Infinity

There are numerous other aspects of "structured deals" that will result in you, the business seller, losing money! See the advice in the conclusion at the bottom of this page with respected how to respond to an offer involving a structured deal.

Bear in mind that £1 Charlies pay over £10,000 to attend a full course from The DealAcademy, for example. And there are other £1 Charlie coaching schools. £10K is a lot of money. You don't pay that kind of money to learn a five minute trick. They pay that to acquire a lot of techniques and tactics to use against you!

WARNING TO OWNERS OF SMALL BUSINESSES

Many small business owners think they are too smart to fall for a £1 Charlie, but even some of the smartest ones have ended up losing their businesses and getting nothing for it!

Because no matter how smart you are in business, the game of buying and selling businesses is completely different. There is a ton to know and you're at a distinct disadvantage because you don't know it.

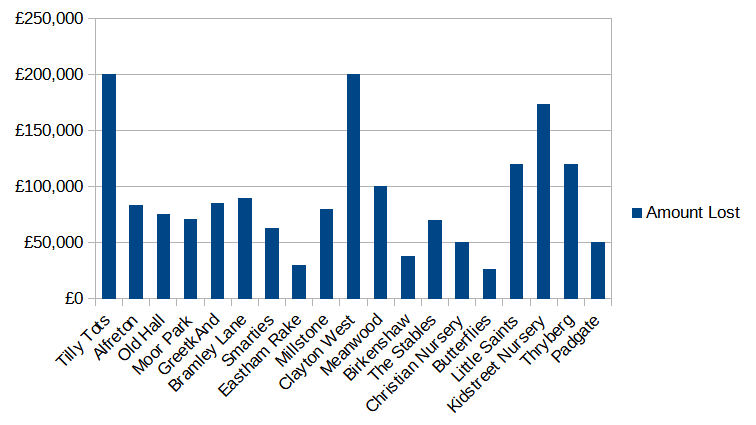

£1 Charlies come in all shapes and sizes. Some are individual operators, some are large, established companies. For example, the UK's self proclaimed "4th Largest Nursery Group", operating under the umbrella of "Welcome Nurseries" persuaded several owners of day nurseries to sell their nurseries to the group under all kinds of "structured deals". Welcome Nurseries was owned by the same person who owns The DealAcademy and who's pitching courses on how to become rich by buying businesses without using any of your money.

Nursery owners sold their nurseries without getting all their payment up front because, well, Welcome was a "big, established, serious looking group", a group that was making noises about getting private equity funding to propel them to the #1 largest nursery operator in the UK. People assumed they were stable. They assumed their "deferred payments" were secure. They were wrong. (Later in this article I'll provide tips on getting proper security.)

After many nursery owners sold their nurseries to the group, the group went into liquidation in August 2022. Below is an image of nursery businesses that were sold to them and how much each of the previous owners of those businesses lost when Welcome went bust. (Source: The administrator's report published at Companies House.)

Welcome Nurseries is the small tip of a giant iceberg. Businesses in other sectors have lost money under deferred payments arrangements they reached with all kinds of £1 Charlie buyers.

But you can protect against this happening to you. There has never been a detailed guide on how to combat £1 Charlies. Till today. So here we go, my LinkedIn posts on this topic are collected below for the general public. (If you want to get more of my tips on buying / selling businesses, follow me on LinkedIn)

- Clinton Lee

TIP #1 THE IMPRESSION MATTERS, BABY!

At The DealmakersAcademy podcast, they advise wannabe business buyers, and I quote the owner Jonathan Jay, word for word: "What you should never do is disclose that you're looking to buy the business on deferred payments or you're going to borrow against the company's assets ....never, never, never...the impression you must give is that you're a multi-multi-million pound entrepreneur."

The "impression you must give", of course! You must give the impression that you're rich because that suggests you're looking to buy the business for money when in reality you want to "buy" the business for nothing.

He adds, "You might say, 'we have recently exited some investments'." (ie, "I've got money!").

Your job as a vendor is to weed the £1 Charlies out early on. I'll later provide ideas on how you can do this by, for example, custom modifications to your non-disclosure agreement (NDA).

If they feed you the line that they've "recently exited some investments", bingo, they've dug a hole for themselves!

Insist on proof that they recently exited investments. They will go all coy, they'll will try to duck and dive, but you must not be swayed. It would be reasonable for you to take a stand: "I need you to prove credibility. You state that you recently exited some investments. Provide proof."

They will use excuses that they are under NDAs and can't disclose that information, or they'll come up with some other excuses.

Do not buy any of it. If they are not willing to share the data with you, suggest they share it with your accountant or lawyer, under an NDA, and your accountant/lawyer can confirm to you whether he's satisfied with that proof.

If it turns out that they won't do that either, it's highly likely that they didn't exit any investments, that they're full of bull manure. Dump them! The earlier you dump a £1 Charlie, the better.

The problem that most vendors have, and this leaves them highly vulnerable to scams, is that they are too reluctant to drop buyers, even when the buyer has demonstrated that he's a liar and/or that he lacks the credibility to complete the deal.

You can also check their companies at Companies House. How long have their businesses existed? Have they filed many years' worth of accounts and do their balance sheets show millions in the bottom line? £1 Charlies tend to have brand new businesses with no history of filing accounts.

Remember, any fool can set up a new company with a fancy name like Westminister Investments & Private Equity Ltd. Many £1 Charlies do just this to give the impression they are serious players. Don't be fooled.

One other check you can do: Visit the person's profile on LinkedIn and go through their past posts, and likes, over the last year or so.

Spend at least an hour or two on this. Have they liked or commented on posts from the http://ukbusinessbrokers.com/business-acquisition-courses/? If so, they probably attended one of those courses.

TIP #2 - THE NON DISCLOSURE

Normally, when a buyer first approaches a seller, or the business broker handling the sale of the seller's business, the buyer has to sign an NDA, a confidentiality agreement, before he's given details of the business.

Business brokers have standard NDAs they send out, but if you're selling your business yourself you may not have an NDA template to hand.

In his podcast #7, TDA advise wannabe buyers: "What you need to do is - you need to initiate the Non Disclosure Agreement....This shows you know what you're talking about, you are going to treat the whole thing professionally and that you know more than they do, which is a powerful psychological position to put yourself into".

So they want to get into a powerful psychological position over you and by having an NDA to hand, and sending it over, they hope you'll get the impression that they are seasoned players who know what they're doing (this will come in handy for them later when they "teach" you how businesses are valued - you're more likely to take their advice, they are experienced, after all).

The podcast goes on to describe an occasion where the speaker sent the wrong NDA back to an accountant handling his client's business sale. He says, "By accident, last year I sent the wrong NDA back to an accountancy firm and he called me back to say ...'it's for a different project' and I said, 'I've got so many going on at the moment'."

Fair enough, if you do have many target businesses you're considering, it could be an honest mistake where you send the NDA for Business A to Business B's accountant.

But he goes on to say, "It was an accident but I thought, you know what 'that's an accident worth repeating'.'".

That was followed by lots of laughter in the audience. And there were, no doubt, some in the audience actively scribbling this idea down.

The message I think he was trying to convey: It might work to your advantage if, as a buyer, you give the impression that you're working on many deals, even if that's not remotely true.

"It's an accident worth repeating" because, in their words, "no (seller) should think they're the only deal in town".

They also advise practising in front of a mirror what you're going to tell the vendor. "The key to all of this is self-confidence," they say.

I'm sure it works with some sellers. Stand before them with enough confidence and talk about having exited some big investments and they may fall for that line if you're confident enough.

Back to "the accident". How can you deal with a buyer "accidentally" sending you the wrong NDA back?

Simple.

Tell him you won't deal with him right now as he seems too busy at the moment. Tell him you want someone focused on the deal, not someone juggling half a dozen other deals where no one deal is of any significant importance to him.

Take control!

It's a gamble you're taking. But the chances are that he's not got a single other deal! It's not easy for investors to find good target business. There's a ton of junk out there but very, very few good business opportunities. So he's probably bluffing!

He will come back to you and, when he does, you're in the driving seat. It means that he now isn't working on any other deals. You're the only game in town for him! You know it, he knows it.

But you don't need to disclose whether or not he's the only buyer with whom you are speaking. You've now got the advantage.

Simply by trying that stunt with you, the buyer has given you an advantage. If he hadn't tried playing games, you would never have known if he was in discussion with any other targets!

I've had numerous buyers try playing that trick with me. On every single occasion I sent them away to clear their existing cases first. They buyer always came back!

There is nothing so powerful as walking away.

One other thing: Never accept the buyer's NDA, you need to have your own NDA ready, and you need to have specific things in that NDA to weed out £1 Charlies, but more about that later.

TIP #3 - THE "ARRANGEMENT"

In one of the above mentioned podcasts, they tip buyers off on a good question to ask: "If we were to come to an arrangement, what would your ideal time scale be?"

Simple enough question and a not unreasonable question at first sight. Your buyer wants to have some idea of the time frame, right?

Wrong.

The important word in the question is not "time", it's "arrangement".

As they say in that podcast, "ARRANGEMENT is a great word. Not 'if I were to buy your business' or 'if you were to sell your business to me'."

They continue, "None of those hard words that start to create a little bit of a reaction in people that this is a sales process. These are all SALES terms and you want to de-sale the sales process!"

Why the distraction away from "sales"? Because in a sale you pay your money and you take your product away ...but the £1 Charlie doesn't want to pay you any money!

You as a seller do not want "if we were to come to an arrangement". You want the conversation to be about "if we can agree a price".

So, correct him.

Tell him, that "arrangement" is a harsh word. Be cheeky. Tell him, "Saying 'arrangement' suggests you want to de-sale what's really a sales process. That makes me sad".

Tell him, that you aren't looking to come to an 'arrangement', you're looking to find agreement on price first.

It's like when you're dealing with a cold caller on the phone. He's got a script, right? He's got a list on his screen of all the things people say in response to his questions and how best to deal with each response. But try asking a cold caller a question he's not expecting, a completely out of the ball park question, and that puts him off his stride.

When someone's playing you based on a script he's learnt somewhere, you need to throw him off his stride.

So don't answer your buyer's question about time frames. Ask him to repeat the question replacing his harsh words with kinder ones that are more representative of the transaction!

You could even say it with a laugh, half-jokingly. But insist he repeat the question! He needs to, however subtly, accept that this is a sales transaction and what you want in exchange for your business is money, not a fancy deal structure.

TIP #4 - THE "POISON PILL"

Put a poison pill into your NDA itself.

When it comes to a Non Disclosure Agreement, send him an agreement that's a little more than an NDA, one that has a little extra clause that will annoy the hell out of a £1 Charlie (but won't be a problem to other acquirers).

Include a clause that says he is agreeing that no future offer of his will contain less than 50% of his own money paid on completion.

If he's a £1 Charlie, he is a character who doesn't want to use ANY of his own money, right? Nothing wrong with that in principle. But he should be honest about it from the start, not pretend to be looking for an investment when what he really wants is to get something for free.

So, poison-pill your NDA. It worked for me against numerous £1 Charlies, including a well known seller of £1 Charlie courses! He got livid that he was effectively being flushed out as a £1 Charlie.

Oh, there's something else.

At the above mentioned podcast, they say that the buyer should do some mystery shopping and call the target business up at different times. It also suggests extracting information from the seller's staff by having a chat with them. Apparently, they say, if the buyer builds some rapport with staff, and digs properly, staff will tell him, "it's been really quiet this month" or "they made 3 people redundant last month".

Hmm.

If you have an NDA, it probably expressly forbids the wannabe buyer speaking with your staff!

I don't know whether the advice in this podcast is for buyers to violate the NDA or whether it relates to cases where there is no NDA / a poorly worded one, but...

Ensure your NDA has very clear clauses against the buyer speaking with your staff and remember that these are dodgy characters so add a clause against him getting someone else to speak with your staff on his behalf. But be aware that he may completely violate the NDA and call your staff anyway!

Reminder: never accept an NDA drawn up by the other side, draw up your own NDA.

TIP #5 - MY INVESTMENT WEBSITE

When buying a business, the buyer digs deep into your accounts. You'll have to share a lot of highly confidential and commercially sensitive information with him.

So it's normal to first identify whether he has the capacity to proceed with a transaction and to confirm he's not just working on behalf of your competitor to do some prying into your business. One way is to ask for proof of funds.

Experienced buyers, and genuine buyers, tend to have no problem with this. They'll provide either a bank statement or a letter from their accountant to say that they have liquid funds of £_______.

£1 Charlies on the other hand either deflect the question, feign outrage that they're being asked the question, or they provide a pretty meaningless letter from a finance house saying something like "funds will be available for the right deal" which means absolutely nothing!

That's not what you want. You want to verify that he actually has the readies!

There's no reason why the buyer can't share his bank statement. After all, you'll going to be giving him all your bank statements for the last several years! Trust me, it's normal in M&A for buyers to provide credential documents.

If he gets outraged that he's being asked to prove himself / his funds / his credibility, I'll bet he's a £1 Charlie!

If he thinks that disclosing his liquid funds is going to affect the sale price, he's not just completely clueless about how these transactions work but he's also a bit stupid. Terms for a business sale are agreed based on the perceived value of the business - a figure that is arrived at after negotiation between the parties. It's not decided based on how much cash the buyer has!

Deflection

In the above podcasts, they advise students how to reply if asked for proof of funds. They are taught to deflect the question with, "I realise that we've never done business before...so I'll send you a quick link to my investment website & my LinkedIn profile so you know who you're speaking to."

That, you need to recognise, is a deflection. Two links, to an "investment website" and a "LinkedIn profile", do not constitute proof of funds! These are both destination pages that can be faked. They can be full of fluff, unproven claims, fake "credibility". They are trying to impress you with their fake credentails to compensate for the lack of real credentials.

Their "INVESTMENT website" is likely a one page WordPress site that proves nothing. Anybody can put one together in a couple of hours even if he's never used WordPress before, but "investment website" sounds impressive, doesn't it? It'll probably have a cliched photo of London city, or a well known commercial building like the Shard, to make it look like a city firm.

Do not be impressed by the graphics on the website. Do not be impressed by the names of the partners / directors on the site, nor in their impressive looking profiles. That can all be faked! Look for a portfolio ie. a list of businesses in which that company invested... and go investigate those businesses. If you find none listed, it's likely this is not the "investment company" that it purports to be!

With respect the LinkedIn profile, it may be filled with a lot of fakery as well - big claims about being an M&A expert or having made numerous investments.

To cover up the fact that they want to pay NO money out of their pocket to buy your business, the above podcasts suggest buyers use this line: "We are reviewing several opportunities and we came across this one on your site..and this actually fits our investment criteria".

"Our INVESTMENT criteria"!

Again, big words. Be on high alert for smoke and mirrors where facts should be. Anyone can come up with "investment criteria", but you want someone who can prove he's capable of making an investment in the first place.

Having an "investment criteria" document is no excuse for the buyer not providing proper credibility documents. If he's not able to provide any, my advice is to drop him immediately. Do not feel timid about dropping a buyer. A "no buyer" situation is better than a "bad buyer" situation!

TIP #6 - DEFERRED PAYMENT

In podcast #9 above, they support a guest talking about buyers persuading sellers that if they get a large pot of money in exchange for their business they'll just spend it, but if they're getting a regular payment per month that could be better for them.

Some £1 Charlies will try that with you.

They'll also try explaining how they can actually pay you a much higher price for your business if you're willing to take that payment on deferred payment terms.

Tempted?

Now there's nothing wrong with deferred payment per se. A lot of businesses are sold on deferred payment terms. But I strongly advise not engaging in this kind of a deal unless you have a good accountant and lawyer advising you through the whole process!

Any promise of paying in the future is only as good as the security / collateral being offered for what is, in effect, a loan you're giving the buyer.

You're handing over your entire business now on an understanding that he'll pay you later. That's a huge loan you're advancing. A loan needs to have three things

- A reasonable interest rate;

- Rock solid security in case the buyer defaults on the payment (as most £1 Charlies are likely to do) and

- A proper agreement drawn up by a lawyer who understands M&A deals.

£1 Charlies typically don't like giving any security that is actually worth anything.

What's good security?

- If he's a wealthy individual, and you have checked that independently, require him to give you a PG (Personal Guarantee) but bear in mind that even a PG is not 100% - there are ways he can wriggle out of a PG;

- Alternatively, he can give you first charge over his family home;

- He can also provide a bank guarantee.

If he's not willing to provide any of those, his intentions are likely not genuine. He doesn't want to take any risk, he wants all the risk to fall on you and for you to have no comeback on him if he screws the business up after handover.

What security do £1 Charlies generally offer? They offer a debenture on the company ie. they offer the business that you're selling them as security for the loan you're giving them to buy the business. Seriously!

But what happens if they run the business down after acquiriring it, or screw it up, or load it with debt, or strip assets? Your business will become worthless and, as it is security for the loan, you effectively end up with no security to claim on when/if the buyer defaults on the deferred payments.

This is what happened with all the owners of many day nurseries who sold their businesses to Jonathan Jay's Welcome Group, on deferred payment terms. When Welcome Nurseries went bust, these vendors lost their future payments under whatever deferred payment contract they had.

TIP #7 - DON'T TELL HIM YOUR PROFIT

One of the questions all buyers ask is, "How much profit did the company make last year?"

In the above podcasts, they advise buyers, "The chances are that (the seller) will fluff the answer!"

If you've never sold a business before, any answer you give to this question is the wrong answer. ANY answer!

I won't go into the why, it's a long story, but don't answer the question even though on the face of it, it's a perfectly reasonable question.

You can say that all the figures are in the Information Memorandum (IM) already supplied.

Maybe get a bit offended he hasn't done you the courtesy of reading the IM.

But don't answer the question.

And certainly, certainly don't get into justifying how it could have been higher or how much personal benefit you derived from the business, about how you pay your family members a small salary to use up their personal allowances, how you construct your business to legally minimise your tax bill, nothing!

Almost every seller of small businesses does that! It is a major mistake. Fight the temptation. Nothing you say is going to be as persuasive as you think! It's still going to be revolve around the disclosed numbers in the accounts and IM.

Do not provide excuses or explanations to cover why your "real" profit is higher than what's shown in the books.

In fact, do not address the question at all.

Those are matters that should be done in writing.

If there's something you want to say that you can't put in writing, give it to your accountant / lawyer to say on your behalf.

If it's something that your professionals can't say either, perhaps because it crosses a legal line, take a step back, remove your business from the market and reassess.

But do not answer questions that really should be in writing or dealt with by the professionals.

You can say instead that once you've qualified him, and vetted him, and seen his proof of funds etc., you'd be happy to introduce the buyer to your accountant to discuss numbers.

If he's a £ Charlie, he's never going to pass vetting and so won't get to speak with your accountant.

But if you've given away a lot of private information about you and your business before he's passed vetting, you've given them away to a very shrewd person, possibly a crook.

There are all manner of ways in which he can use that against you.

TIP #8 - THE MIDDLEMAN PROBLEM

In many of the above podcasts, they advise business buyers to avoid businesses being sold by business brokers and to prefer businesses being sold directly by the owner.

Selling a business is a complicated affair. Most owners of small businesses have no idea of how really complicated it is and the millions of traps awaiting the unwary. If they have a good business broker or corporate finance firm acting for them, they've got a seasoned pro on their side.

£1 Charlies don't like the seller having a professional on his side.

A professional will be able to see through the £1 Charlie's tricks, and the £1 Charlie doesn't want that.

They advise students to deal directly with vendors and advise students how to probe sellers for weaknesses. They advise why buyers shouldn't target businesses being represented by brokers, "as soon as (you've) seen the the weakness (you) know exactly where to strike whereas when you've got the corporate finance house or broker in the middle then you're restricted from seeing all of that."

What's your best defence against this as a seller?

Ideally, you want a good broker / corporate finance firm / other transaction advisory professional assisting you. But that can sometimes be expensive, and your business may not be big enough to afford one. And it can sometimes be difficult to find a good one. So my advice would be to

- Spend a lot of time reading the advice on this site and elsewhere;

- Be vigilant in identifying £1 Charlies as early as you can (how to vet buyers);

- Be bold, and quick, in dropping a buyer if you suspect he's a £1 Charlie and

- Do not attempt a transaction without a good M&A / transaction lawyer.

.

TIP #9 - PSYCHOLOGICAL MANIPULATION

One of the pieces of advice they give at the above podcast is this: "Remember, if someone calls you and you really aren't in a position to sit down in a quiet room with a pad and pen and your laptop open to look at the website while they are talking, you must always call them back."

That doesn't seem bad advice. In fact, it's sound advice. But they go on to say,

"You must maintain control of the situation. The best way to keep control is that you call them when they are unaware, when they're on the hop....this is all about taking the psychological advantage."

They want to catch you "unawares"!

Then, when you get the seller on the hop, the advice is to ask the seller specific questions, note the answers, and then later in a different meeting, ask the same questions to see if there's any variation you can exploit.

The example given is about "timeframes".

The first time you speak to the seller, the podcast says, if you ask him about time frames, he'll be a bit nonchalant and say there's no hurry.

The next time maybe you meet him in person and casually ask again. He may disclose that he needs to sell by Easter.

That gives you an advantage, they're told. "You know he's under some time pressure."

So how do you, as a seller, combat this kind of psychological manipulation?

What can you do apart from calling HIM on the hop or otherwise getting HIM floundering and flustering because he doesn't have a pad and pen handy (perhaps because you "accidentally" bumped into him outside his office)?

You do it by scheduling all calls. Do not tolerate him calling out of the blue. You have a business to run and he needs to respect your time. If you've got a broker or advisor handling your sale then the buyer should be calling the broker, not calling you!

.

TIP #10 - FAKE IT TILL YOU MAKE IT

In his podcast #4, TDA say in relation to talking to a seller whose business is already on the market with a business broker, "Sometimes people will ask you if you've heard of the broker. And the answer is no. Always no. No, never heard of them, never come across them....".

Feign ignorance!

There's a reason for this ...but the important lesson to take away is: You cannot take anything a buyer says at face value. He could be a £1 Charlie in which case he's probably blagging his way. Whatever he's saying, about anything, could be a lie.

£1 Charlies are taught to "fake it till they make it". They are taught to act like big shots, like wealthy individuals, like seasoned dealmakers.

So they'll boast about other transactions they're currently working on.

Or they'll provide an "acquisition criteria" document to say they looking to acquire businesses in xx sector that are generating between £200K & £500K (or whatever other numbers).

Or they'll say they're going to take your business to a stock market listing.

There's plenty of other big talk where that came from, but they will be very, very reluctant to talk specifics.

So ask specifics.

"What other transactions have you done?"

"We are currently in negotiation with several targets but we can't disclose the names as we're under NDA"

"OK, so tell me about past deals. What companies did you buy? What did you sell? What do you currently own?"

"We can't disclose that"

"That's strange. Other investors have always been keen to show off their history. I'll have to assume that you've not really done any transactions. That's fine, we can proceed, but we do it on the understanding that if you cannot prove something you've said, I'll take it that you're just trying to blag your way!"

"If you're looking for businesses generating £500K, then you must be big players."

"Yes, we are. We are serious investors."

"OK how much of cash can you prove in your bank account right now to cover the rest?"

"We can't show you our bank statements! That's ridiculous"

"Why not? You're going to be asking to see mine, aren't you? And I only need to see your balance, not your transactions!"

"What do you intend to do with my business post-acquisition?"

"We have a buy and build strategy to create a large group."

"One of the UK's self proclaimed acquisition experts tried that in the nursery sector recently (Jonathan Jay) and he failed miserably. It's a lot more difficult than it looks. What evidence do you have to show you've got these buy and build skills? Or are you driving with L plates here? Just to be clear, let me emphasise that I will want payment in hard cash, not shares in some "group" company that's going to go IPO or whatever in the future. You might have great confidence in your own ability to build a large group, despite never having done so before, but I don't have any reason to share that irrational exuberance of yours."

"You say you are connected with several High Net Worth Individuals who'll fund this deal"

"Yes, absolutely. There is no problem with raising funds."

(Yeah, right!)

"In that case, have those individuals come & speak with me themselves. I'll deal directly with the organ grinder rather than someone who has to go back and forth getting approvals and sign-offs."

CONCLUSION

This page has but a small selection of quotes from a small selection of podcasts from The Dealmakers Academy website. This business has more than a 200 other podcasts with more tips for buyers! And lots of YouTube videos as well. I may post about more of them later. But ...

If the above tips are what they are sharing publicly, you bet the private tips they are giving attendees of their £10,000+ programme are likely to weigh the scales even more against you.

And The DealMakers Academy is just one course churning out £1 Charlies. There are at least a dozen more.

The £1 Charlie problem is real and significant. Experts estimate that 90% of the "buyers" and "investors" in the market today are £1 Charlies.

Use professional assistance to sell your business if your business is large enough to afford it.

If your business has £5m in turnover or £500K in net profit, get in touch for assistance with finding the right coporate finance / investment banking / M&A professionals to sell your business.

And remember that if it's a small deal, £1m or less in value, it's quite normal for the consideration to be paid largely (or completely) in cash and without any of that structured deal nonsense.

"Structured deals" are what happens with the very large businesses, not with small and microbusinesses. The larger the business, the more "structure" there tends to be in the deal.