Some background checks on companies & individuals who claim to be "investors" buying businesses.

If you've been approached by someone who wants to buy your business, you cannot afford to ignore this page. Read it in its entirety ...and then read it again!

Beware! The person who approached you to buy your business is possibly a £1 Charlie ie. someone who looks and plays the part of an "investor" but who, in reality, has no money to invest. For a full explanation of the £1 Charlie problem, see our detailed notes at the bottom of this page.

Don't be fooled by the self-aggrandising names they give their companies with use of "private equity", "capital", "holdings", "international", "acquisitions" and "group" commonplace in company names. Most firms with such names are worthless shell companies.

You need to check the company out yourself, check the individuals behind the company, check the funds the company has available for deals (yes, you can ask them for proof of funds!)

Below are some names we've come across - people and firms who've approached business owners to buy their businesses or who are otherwise claiming to be interested in making acquisitions.

We ran investigations on a few names to provide some indication as to what you, the business seller, can do to satisfy yourself about their ability to do a deal. Below are examples of who comes across to us as genuine and probably funded and who doesn't. These are the differences for which you're looking.

We make no comment about their character or ability of the people involved, we state simply the findings from our research into them. Note: Where a company we have listed below does not come across as funded, it may be the case that the owners / directors are independently able to fund a deal but it does not mean they are not £1 Charlies. They could still be looking to engineer a situation where they pay you nothing for your business.

Further Reading: How To Vet Buyers and Investors

Optimum Asset Growth Limited

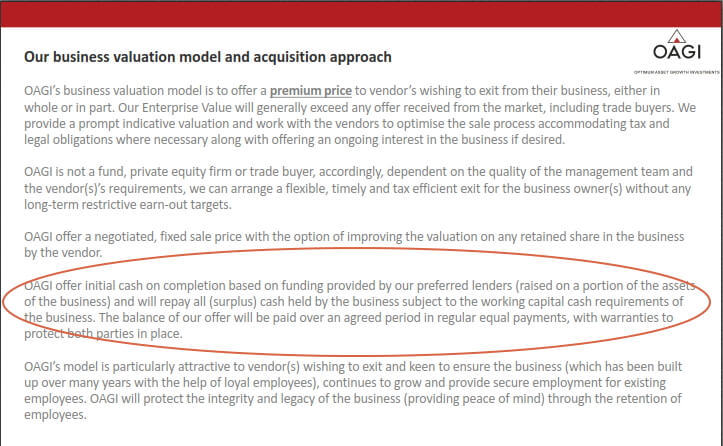

The claim on their website is this: "The value of our proposal and offer to acquire a business is in our ability to safeguard and preserve the assets, unlocking and delivering the growth potential post acquisition; the key objective is for scalable growth and sustained development, from which rewards will flow to employees, stakeholders and notably to the vendor, who will have a generous offer for their business."

So it looks good, right? "Generous offer"?!

Read our other tabs above for why this is not as rosy as it appears.

Fidelis Group Limited

IBG Group Ltd

Durson Holdings Ltd

DA Capital

Cliffe Holdings

Professional Acquisitions

Mansell Capital Ltd

Black Hat Holdings

Black Hat Capital LLP

ElCorde Group

Hebsy Ltd

DGG Capital

Modus Enterprises Ltd

All these firms use the same copy on their website and/or their social profile - the exact same wording, paragraph after paragraph of it (see our second tab above). This suggests they're related in some way and/or operating to the same business plan.

On investigation we have discovered that this "copy" is common to all "investors" who attended a course run by a certain Guy Bartlett who claims to teach people how they can buy a business without investing any money or taking any risk. Perhaps it is copy he has provided to them as "copy that works".

Given their association with Guy Bartlett, one may be forgiven for drawing the conclusion that the above firms are looking to do "no money down" deals.

Seronera Capital Partners

Our Recommendation: Worth Checking Out

We provide this as an example of what signals look different with a genuine investor.

You'll notice that the name doesn't tell you much. It has the word "capital" in there which many of the bad guys also use in their company names.

However, there's are some key differences on their website.

This company has a list on its website of businesses it has acquired! Real names of real companies. And these are names that can actually be verified.

Further, they also have a list of companies they have exited / sold. These can also be verified. Importantly, Seronera's previous ownership can be checked.

Fake "investors" don't provide names of businesses in their portfolio (often because they don't have a portfolio) and if they do have names on their site, it'll usually not be companies that you can independently verify actually exist.

You need to verify the ownership of those companies as well. Fake "investors" are known to occasionally claim ownership of companies with which they have no connection!

AEIM Group Limited

Marlborough Scott Limited

CP International Ltd

Blue Square Group Holdings Limited

Vitae Capital Ltd

JWOM Ltd

Our Recommendation: Avoid Or Investigate

The copy on these sites, like with the previous batch of companies, is boilerplate text.

You can generally safely discount any "investor" promising a "win-win" deal.

The win-win terminology is most often used by unfunded buyers. In their mind they believe they're offering you a higher price (your "win") and in exchange they pay little or nothing now and pay it all out of future earnings of the business (their "win").

In reality, vendors selling under those terms rarely or never get the full amount that was agreed.

Click the Google image below for evidence that they are all using the same copy, possibly obtained from a course they attended.

Most of them say, "We have access to finance from a private equity fund, plus a wide range of commercial funders and we also have a network of High Net Worth Investors for the right deals."

They don't state that they have any funds to invest. The vague reference to all the rich people they know is typical tripe from fake buyers - they know you can't actually verify their connections with rich investors. Just trust them. After all, they are "Group" companies or "Holding" companies!

Deals not backed by the buyer's own funds often collapse at some point during due diligence, or are otherwise problematic because third parties keep moving the goalposts. So even if they do have these connections, our advice is to avoid them.

Wolfgang Capital LLP

Our Recommendation: Avoid Or Investigate

More details coming soon.

White Stag Holdings Limited

G4 Acquisition Group

Catham Holdings

Orchestra Acquisitions

Turnhold Group

Leysman Group Holdings Ltd

Our Recommendation: Avoid Or Investigate

More details coming soon.

Verdani Investments

Nov 11, 2020: Other names will be shortly added to this list of "Companies where the owners may be privately funded but the company isn't"

Verdani Investments is interesting because they boast a whole array of M&A awards on their website, but the company called Verdani Investments Ltd was registered only in 2017 and three years later, when we checked in October 2020, statements at Companies House showed it had never traded. It was still a dormant company!

So we did a bit of digging. On their website they claim they are building "a group of UK and global based companies with sales revenues exceeding £150m with a minimum net profit of 10% by June 2022."

Interesting! But the "they" would seem to be not Verdani Investments Ltd, but the owners of Verdani Investments. So the claim on their website is not completely accurate.

The owners / people behind this business do have other business interests but, contrary to what the website suggests, this company doesn't seem to have made any acquisitions so far.

MC International Group

MC International Group is building "a group of UK and global based companies with sales revenues exceeding £100m".

Where did we see that copy before?

It's copy that appeared on at least two other websites. The website of a Stephen D Pratt and Verdani Investments Ltd.

(This section is work in progress. More material to be added later. Nov 11, 2020)

DIF Capital Partners

Our Recommendation: Worth Checking Out

We provide this as an example of what signals look different with a genuine investor.

Right off the bat, on their website, you'll see a statement saying "Established in 2005, DIF is an independent fund manager controlling €8.5 billion of assets"

Established a long time ago! And still trading! So if you can verify they actually have been in existence that long then you're on to a real investor, not a scam artist.

Note, also, the claim on the money. 8.5 billion. That's a lot. But the key difference here is that they are not talking about that number as a target or a vision but an actual real life, current number!

Scam artists talk big numbers, but they talk about these numbers in the context of what they see happening in the future. They don't provide figures for how much of capital they have invested now.

BlackHouse Private Equity

Eden Capital Partners

Kplex Capital

QQMA Group

Our Recommendation: Avoid Or Investigate

As per this screenshot from a Google search, here is another bunch of companies using exactly the same copy on their websites:

"Our mission is to unlock the full potential of the businesses we acquire by empowering the people within. We believe entrepreneurs are the driving force ..."

Of course it is. Noble mission. Or is it somebody else's noble mission that sounded nice so they reproduced verbatim?

Real private equity firms don't use competitors' (or boilerplate) copy on their websites. They pay proper money for designers and copywriters to write bespoke material, they don't do it on the cheap for £50.

More Businesses Coming Soon

More coming. Free feel to send us your own recommendations or companies you'd like us to check out for this page.

Background to the £1 Charlie disease

2020: Over the last five years or so there's been a proliferation of courses purporting to teach people how they can buy businesses without using any of their own money.

Thousands of wannabe business owners in the UK have signed up for these courses and come out thinking that they, too, can buy a business even if they don't have money to invest. That so called investor who has approached you ...may actually be angling to get his hands on your business without investing any money.

In summary, these courses teach that it's all in the "deal structure", that LBOs ("leveraged buy outs") are how businesses are bought, that the best deal is one where you pay a small sum of money, or no money, now and the balance in the future.

And the sum of money they are using as the down payment, if they are making a down payment, can be generated from the business itself according to these courses. In other words, they can use the money in the business bank account to make this down payment or they can borrow against the stock in the business or against the debtor book.

What they want is to invest none of their own money and, voila, still end up the proud owners of a business.

What these students are not taught is that the no money down deal, or the £1 deal, is generally applicable only in the case of distressed businesses. To get the owner of a sound, profitable business to hand it over for £1 takes a lot of guile and, sometimes, trickery.

These students have learnt some tricks in the course, but those are generally not enough. That's why there are hundreds of wannabe "investors", like the ones listed at the top of this article, who've registered companies years ago but haven't been able to close a single deal yet!

These "investors" slowly come to realise that it is far, far more difficult to pull off a £1 deal in real life than they were led to believe in the course.

But that doesn't stop them trying. Every day these investors, thousands of them, are sending out emails and letters, making phone calls, doing everything possible to get through to owners of businesses and express interest in buying / acquiring.

That approach you got is more likely from one of them than from a genuine investor.

The problem for business owners is that £1 Charlies are often deceptive about their intentions and lie about their funding. They do not disclose that they are angling for a £1 deal and, instead, pretend to have HNWIs (high net worth individuals) behind them or partnering with them. They pretend to have lots of money and lots of acquisition experience behind them. They choose fancy names for their companies to aid their deception.

It's very tricky telling them from real investors.

Differences between proven investors and the candidates who are highly likely to be unfunded, inexperienced, highly risky players.

1. Real investors tend to have examples of previous deals on their websites (not just claims of having done lots of deals). They'll have names of businesses they've bought and you'd be able to go to Companies House, or elsewhere, and verify those claims.

2. Don't be fooled by company names. Words like "private equity" and "capital" and "assets" and "group" in the company name mean nothing. The firm could still be a brand new, unfunded entity which has a fancy name just to impress.

Research the firm independently. Check how many full time employees it has on LinkedIn. Check the profiles of a few of those employees / directors. If they don't claim on their profile that they are full time employees of the company, they likely are not. It may even be that they are not associated with the company at all and are unaware that their names appear on the company website!

3. Real investors do not have any qualms about proving liquidity, about showing proof of funds. Unfunded buyers, amateur buyers, £1 Charlies often get offended when asked to prove, prior to getting highly confidential information, their ability to do a deal. Or they provide some low quality (non) proof, like a letter from a finance company saying that "funds are available for the right deal".

If they claim to have a partner or High Net Worth Individual or someone else providing the funds, which they often do, you can ask to speak to that person and you should ideally obtain independent evidence that the party can indeed fund the deal.

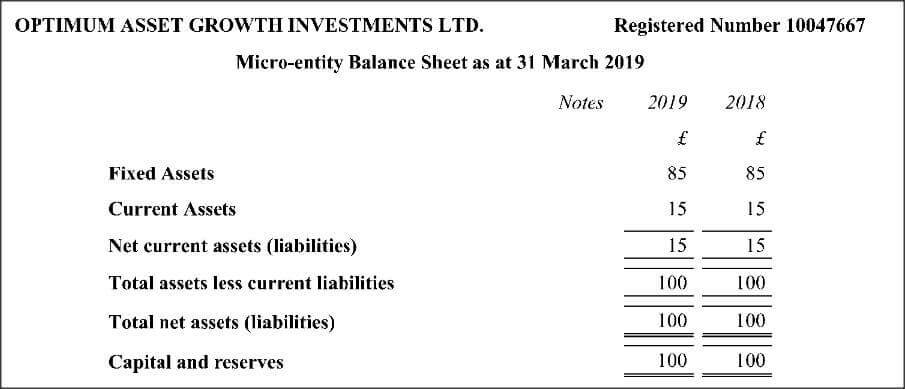

4. Always research the firm at Companies House. Have a look at how long they've been around and what their last balance sheet showed as Shareholder Funds (or Net Assets). If the figure is not in the hundreds of thousands, or millions, they are probably not serious players. Note that numbers in brackets are negative numbers and one should be even more cautious dealing with companies that have negative balance sheets.

If it's a dormant company, or a company that was only created recently and hasn't yet submitted their first accounts, the chances are that they are not funded buyers. Take extra precautions, conduct further checks.