The Myth: A business is worth only what someone will pay for it

The first question raised by business owners looking to sell their business usually revolves around valuation: "What is my business worth?"

And the most common answer they get is that a business is only worth what someone is willing to pay for it.

That line is everywhere!

Search Google for that text and you'll find thousands of results. Articles, blog posts and forum discussions are unanimous in their view that, when it comes to business valuation, beauty is in the eye of the beholder.

These articles continue to explain that whatever the underlying assets, strengths, earnings or prospects of the business there may be financial formulae that can estimate value but, in reality, it's worth whatever buyers are willing to pay i.e. go to market and see what buyers offer you.

Their conclusion: The buyer is the one who decides the worth of your business.

There are two problems with this. The first is that, in real life, the buyer with the top bid often can't arrange the finance ... and has to pull out of the transaction. Yes, they offen talk big but realise their credit isn't as good as they thought it was and the bank's not willing to lend them the funds they figured they could borrow.

So, at the very least, we need to modify the saying. Maybe, "a business is only worth what a buyer who has the means and will to complete on a purchase is willing to pay for it".

But even that puts all the trump cards in buyers' hands. I say it's time for a rethink. To me...

The business is not worth only what someone is willing to pay for it.

It's worth what you can get someone to pay for it.

Selling a business is essentially a selling job.

It's not about what buyers are willing to pay ... it's about what you (or your broker) can negotiate. It's about finding buyers who have the means and will, making a good case for a higher price and convincing the buyer to pay it.

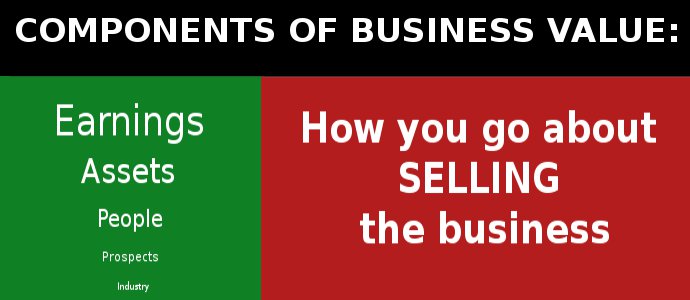

A large part of the price achieved - in fact it's often over 50% - depends on the skills of the vendor (or the advisers he's using) i.e. it's not based exclusively on the intrinsic value of the business such as assets, EBITDA etc. And it's not dependent entirely on the state of the economy or the industry.

The Five Ps of the broker value-add:

- Preparation prior to sale;

- Packaging;

- Presentation, including copy of the teaser ad. and Information Memorandum;

- Promotion, including the where, how and to whom; and

- Persuasion - the ability to negotiate a good deal against the toughest negotiators.

When it comes to brokers, your business broker needs to not just sell your business - s/he needs to add value!

And they add value by making your business more attractive to buyers, better preparing and presenting the business for sale, better marketing of the opportunity to investors and getting the right investors in ... and by being not just hard at negotiation, but savvy.

The value the broker adds should be, at the very least, a few multiples of the fees they are charging.

Final Words

However attractive your business is to buyers you will not get top whack unless you (or your business brokers) actively put in the effort and the smarts towards getting it!

And there are specific things that can be done to attract strategic buyers, the kind who'll value your business not on the earning or the assets, but on the potential they can develop, on synergies they can exploit.

Get in touch if you wish to discuss how I do it or if you would like me to assist you.