Loan Book Valuation: Getting the Best Price For Your Debt

Selling a business usually involves selling the business assets as well as liabilities. The new owner takes ownership of the debt book - the accounts receivable, the debtors who owe you money - as that is an asset. He can sell that debt or raise finance against it.

But is selling that debt something you should do before you put the business up for sale?

Most businesses have money owed to them - this ranges from unpaid invoices to loans. But where a firm is a direct lending business, they tend to have much larger sums locked up in such debt.

Debts are often sold separately to other business assets. Where debt is a significant proportion of the business's total assets it makes sense to ensure the best price is achieved on this component of the sale.

How Does Selling Debt Work?

A debt sale is when a business buys the debts owed to another business.

According to Outstand.io’s guide to selling debt, the selling firm sells the debts for less than the amount owed, but the price is fixed and provides financial certainty to the seller.

The buyer takes full ownership of the debts and will collect on these accounts as their own.

Selling debt also allows the seller to refocus energy back onto what they do best, and away from chasing debts that are too time consuming or challenging to collect.

Debts are usually bought by Debt Collection Agencies, who are specialists in collecting debts and may collect these debts over a much longer period than many consumer credit firms are able to stomach.

Debt collection agencies also have rigorous processes and workflows that help to make the collecting of debt more efficient meaning they will collect more and it would cost them less to do so.

This is why a debt sale can be extremely beneficial for both the seller and the buyer of the debt.

On the other side of the coin, if a business has liabilities related to loans they've taken on assets like machinery or stock, the acquirer usually assumes this liability on acquisition.

However, the original debtor may still need to be the guarantor of the outstanding loans. If the buyer fails to make payment the creditor will turn to the guarantor for payment. So, where possible, it may may sense to liquidate non-critical assets such as the debt book and use to funds to clear loans.

When Might A Company Look To Sell Debt Outside Of A Business Sale?

To prepare for a business sale:

The sale value of outstanding debt depreciates over time, as typically the more time that has passed since the debt was owed the more challenging the debt is to collect. If selling a "lending based" business will potential buyers want the company to have lots of outstanding debt depreciating on the company accounts?

Typically, when a finance company is bought, the buyer wants to acquire customers and to grow the business on its own (or by merging it with the buyer's business).

In either case, and even with non finance businesses, the objective and focus of the buyer is likely to be on new customer acquisition and increasing lifetime value of the customer as opposed to efficient and effective overhaul of collections methodologies.

When a business is bought it is done so based on its value, which includes the value of the assets. But buyers of the business may low ball on price based on a lack of certainty around expected collection rates from outstanding debt. Selling debt prior to a sale provides certainty to prospective buyers.

It is also likely that the buyer will look to sell the debts anyway so doing this prior to the business sale may relieve a large administrative burden from the business buyer.

When entering administration:

When a business is entering administration it must act in the best interest of creditors, which often translates to the debts owed to the insolvent business being sold.

Fine examples of this recently have been high profile lenders such as Wonga, Quickquid and Brighthouse who have had to sell their portfolio to specialist debt collection agencies.

A sale of this type is slightly different as it is usually without liability, sometimes referred to as ‘sold as seen’. However, when a solvent business conducts a debt sale there are usually various contractual clauses and indemnities in place to protect the buyer should any of the debt be ineligible.

For instance, debt could be "ineligible" if it later turns out to have been obtained fraudulently.

Using a broker in this scenario can be sensible as often Insolvency Practitioners work across an array of business types, whereas a specialist debt sale broker will have a much deeper understanding of the potential buyers to attract in order to demand the highest sale price.

Industry research suggests there were 810 Debt Collection Agencies in the UK in July 2019, so it is extremely important to ensure that the right potential buyers are brought into any sale process.

What Types Of Debt Can Be Sold?

Most types of debt can be sold, though the value obtained can vary significantly.

Debts from a business lender can be sold in a similar manner to consumer debts. Business debts are often in the form of outstanding invoices (and invoice factoring has become popular also).

Consumer Debt

For the debts of lending businesses where money is owed by consumers, such as the examples given earlier, these too can be sold. Consumer debt of all types such as car finance, credit card, energy debt, bank loan and high cost short term credit can be sold to a Debt Collection Agency.

The most established reason for selling debtor loan books in the UK is non performing loans.

Consumer lenders are usually focused on growing their business through new customer acquisition and improving customer retention so chasing non performing debt can be an expensive distraction from their business objectives. Inefficiencies in collecting problem debt can also become a burden to businesses accounts with the provisioning requirements of IFRS 9.

If a firm has entered into administration then the whole loan book may be sold, which may be made up of non-performing loans as well as up to date loans, but usually a lending business would not look to sell debt if it was being paid by the debtor within an agreeable period of time.

An often overlooked market for debt sale is consumer debts where the consumer is in an IVA, Debt Relief Order, Debt Payment Programme, Sequestration or Debt Management Plan.

These debts can be problematic for businesses due to the long nature of the agreed repayment schedule and that the full balance may never be recovered. Selling these accounts to a specialist collection agency who can afford to accommodate these much longer repayment schedules can free up valuable time and money to use elsewhere in the business.

Business Debt

Large businesses which have shares are able to sell them through a Share / Stock Purchase Agreement. This is where the seller transfers ownership of the business by transferring the shares to the buyer. As the new owner of the shares, the buyer can appoint his own directors to make executive decisions, but the new business he owns is ultimately responsible for collecting all the money people owe the business and to pay all the money that the business owes to creditors.

Smaller businesses are often not incorporated and so do not have shares to transfer. The only option they have is to sell the businesses through an asset sale. Share sales vs assets sales are covered here.

In both cases the debtor asset is transferred to the buyer.

How to Value A Loan Book?

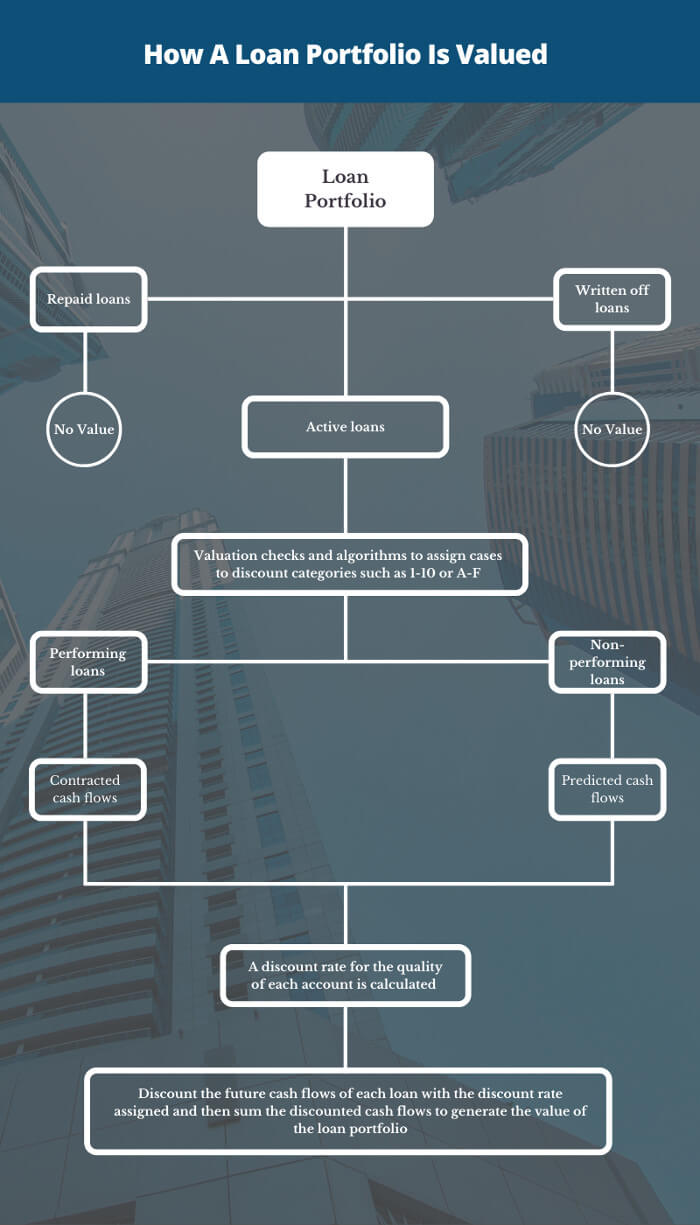

Prospective buyers of a loan book will analyse the data and business model to essentially determine how much money they can reasonably expect to collect from the debts within an acceptable time scale.

They will then deduct their expected costs to collect the debt and deduct their profit margin etc. So do not expect them to pay the full value of the debt.

The seller has the choice of either including the debt book asset with the sale of the business and asking for a price that includes this value ...or selling the debt book separately prior to selling the rest of the business.

Obviously, when selling the debt book prior to selling the business, the seller can extract full value for it and not be subject to the deductions buyers would make when valuing that debt book.

How Do Debt Purchasers Value The Book?

A Debt Purchaser is in a good position to be able to assess the value of a loan book.

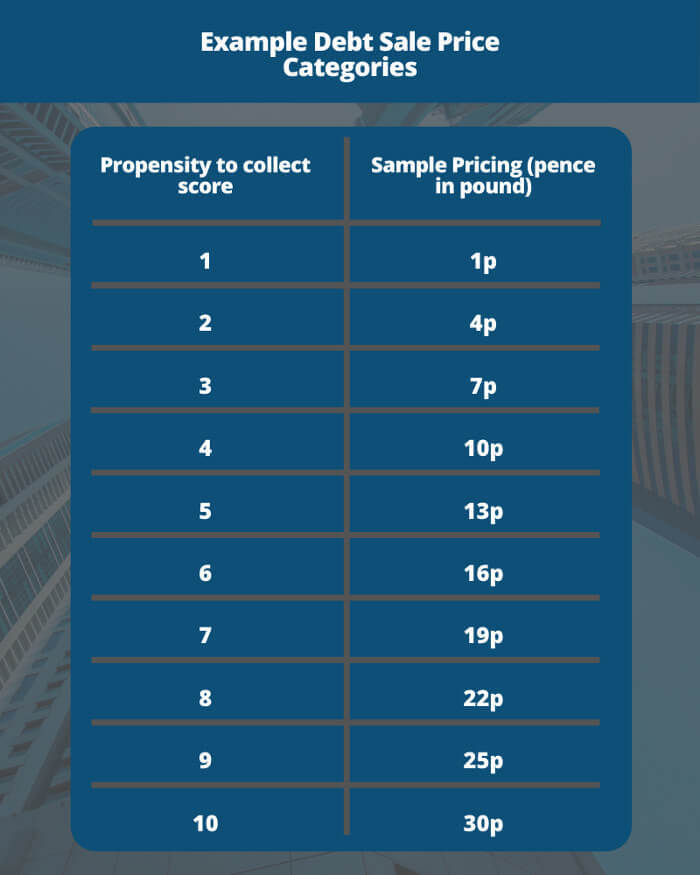

In the way that most large lending businesses use algorithms to assess the risk of an applicant defaulting, Debt Purchasers assess the propensity of being able to reclaim each debt based heavily on the results of other debts that they have previously bought.

Some Debt Purchasers have developed algorithms that utilise machine learning techniques to assess the data provided from their collections arm to help inform the Debt Purchase price, looking at many different data points.

There are a number of factors that affect how much a loan book may be worth and all Debt Purchasers will have a slightly different appetite for each variable. When thinking about how much debt may be worth, the following may be worth considering:

• Are the debts secured?

• In what country within the UK are the debtors residing?

• Have you outsourced the debts for contingency collections previously?

• How old are the debts?

• When was last contact made with the debtors?

• When were the last payments made on the accounts?

• Do any of the debtors have any known vulnerabilities?

• How old are the debtors?

• Can the debtors not afford to pay or are they refusing to pay?

There are numerous other factors but one of the largest factors cannot be known prior to going to Debt Purchasers for valuation purposes.

When a Debt Purchaser analyses a debtor portfolio they will check how many of these debtors they have previously held accounts for!

If they can see that 40% of the debtors have had other accounts placed with the same Debt Purchaser in the last few years and 90% of them repaid then this will drastically increase the purchase price.

Knowing which creditors are most likely to have seen similar debts can be a useful way to locate Purchasers with high ‘match rates’ to understand how the debt will perform for a Debt Purchaser.

It may be also worth carefully considering what data is provided to a Debt Purchaser.

For example, work contact details for the debtors, and email addresses, for instance.

The Debt Purchaser is likely to spend money on identifying contact information for the debtor where they do not have the correct details so helping them with as much information as possible helps them keep their costs down.

As the purchase price is impacted by the expected costs of the Purchaser to collect the debt, reducing that cost for them allows for a higher purchase price.

Credits: This article was written by Rob Samuel of Outstand.